The Red Giant

Tomorrow is the big day. The inauguration of the 47th president of the United States will take place on the 20th of January inside the United States Capitol rotunda in Washington, DC. No matter how important and consequential many believe this event will be, the change in administration will serve only as a milestone in the world’s biggest economy becoming a Red Giant.

Thank you for reading The Honest Sorcerer, and special thanks to those who already support my work: without you this site could not exist. If you are new here and would like to see more in depth analysis of our predicament, please subscribe for free, or perhaps consider a paid subscription. You can also support my work by virtually inviting me for a coffee, or sharing this article with a friend. Thank you in advance!

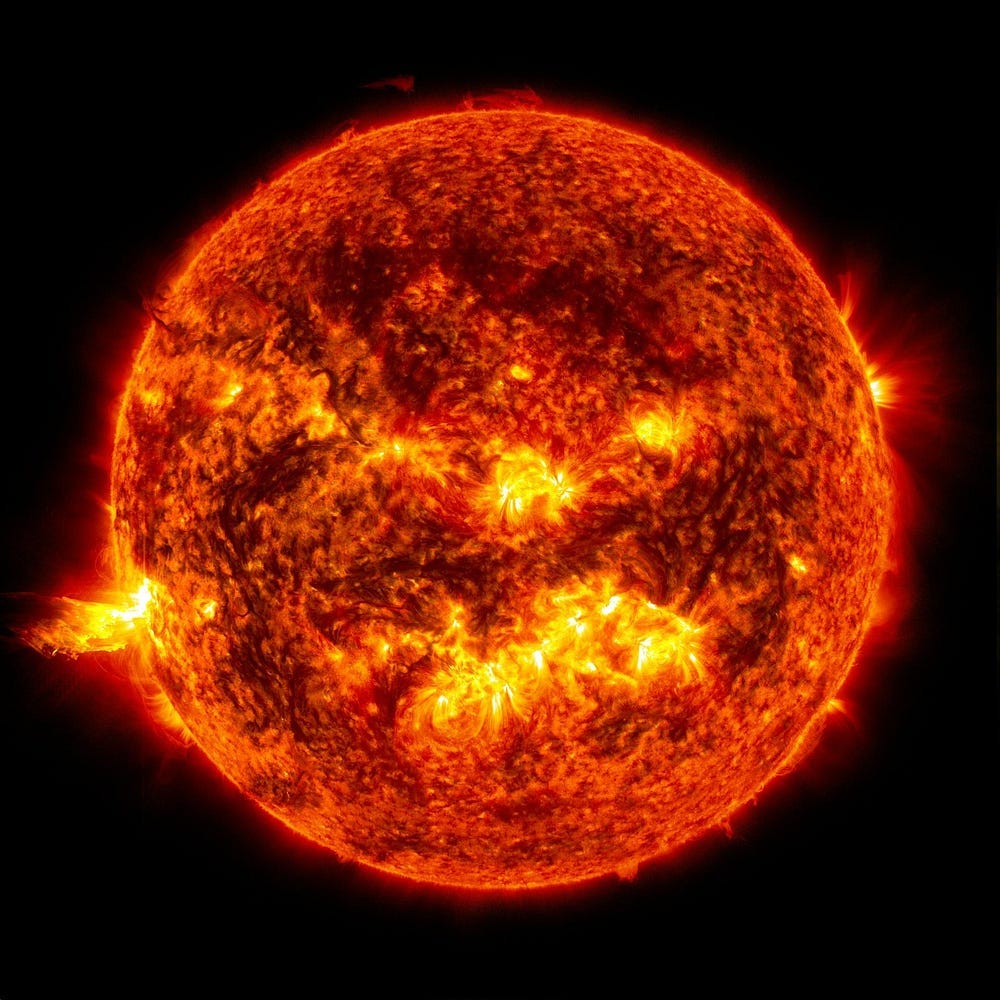

A main-sequence star, such as our Sun, converts hydrogen into helium in a slow and steady manner; radiating an immense amount of heat and visible light in the process. By the time our central star will have used up most of its hydrogen — about 4 to 7 billion years from now — it’s outer layers will begin to expand. Having lost its internal equilibrium the Sun will eventually transform into a red giant, scorching then absorbing all inner planets. After the red giant phase it will shed its outer layers, and will become a small, dense, cooling star — a white dwarf. It will no longer produce energy by fusion, but it will still be glowing incandescently until it slowly fades away… In about a trillion years.

Industrial economies, like that of the US, convert fossilized sunlight (coal, oil, natural gas) and minerals into consumer products and pollution, consuming their resource base in the process. Unlike the Sun, such economies do not have billions of years to complete their lifecycles, though. Industrial economies must consume energy in an exponential manner in order to compensate for the steady loss of cheap and easy-to-get minerals they need for maintaining their inner equilibrium. As soon as their rate of energy conversion fails to keep up with the ever growing needs of their economic engine, though, large economies — much like main-sequence stars — tend to expand into a red giant, scorching and consuming all neighboring states in the process.

The American economy, based on oil, has long left its equilibrium phase. After the first major hiccup in the 1970’s, when its domestic oil production abruptly peaked and began to decline, it staved off collapse by rapidly outsourcing its energy intensive economic activities, and starting to extract Alaskan oil in large quantities — at a much higher energy cost than it used to do in Texas. Just like stars switching to fuse helium instead of hydrogen, this switch came at a heavy price, though. To make up for the loss of cheap, easy-to-extract oil, credit expansion was reverted to to fuel continued growth, but it ultimately failed to reproduce the energy bonanza enjoyed during the 1950’s and 1960’s. Consequently, instead of seeing a return to real economic growth, a debt bubble began to inflate. Meanwhile, perhaps not surprisingly, US oil production continued to fall and the nation’s energy consumption followed suit; only to return to a much lower rate of growth during the 1980’s and 1990's.

Although neoliberal economic policies (free-market capitalism, deregulation and a reduction in government spending) together with the onset of globalization and the collapse of the Soviet Union helped to stabilize the situation somewhat, giving America its unipolar moment, it, too, failed to restore prosperity. As a result of these policies, on the other hand, millions have died or have been displaced in foreign wars, while wages became trapped at home. This trend was made even worse by the steady decline in the purchasing power of money, and was offset only somewhat by ‘credit adventurism’ and cheap imports from China. The onset of a major economic and financial crisis was not a question of if, but when.

After the 2008/2009 great financial crash all prior concerns towards money printing were dropped, and a Zero Interest Rate Policy (ZIRP) was implemented to reflate the bubble and restore lost confidence in infinite growth on this very much finite planet. This sudden influx of money gave rise to the shale revolution, touted as the savior of the day and a cure for peak oil. Due to the stubbornly high energy costs of drilling millions of holes into shale rock formations and fracturing them under immense pressure, however, it, too, failed to reproduce the miracle of exponential economic growth. The chart above tells it all: oil consumption continued to stagnate, while coal production fell like a rock — only to be partially offset by an increase in shale gas production. Despite fracking, nuclear, wind and solar a steady decline in energy use and another round of deindustrialization could not be avoided. The relentless rise in the energy cost of obtaining energy took a steep toll on the economy. And now, with a looming peak and decline in shale oil extraction, an accelerating fall in energy production seems all but inevitable.

Geology is destiny. No energy and mineral resources — no economy.

Money, stocks and bonds are mere claims on future consumption, all of it made available by energy use. Food, cars, houses, vacations abroad, consumer goods all take an immense amount of energy to make, thus decoupling (real) economic growth from energy use is nothing but a figment of imagination. As a result of a stagnating then falling energy use and an exponential increase in the amount of credit circulating the economy (distorting the GDP metric heavily), the share of manufacturing in the US fell to a meager 10% of GDP in 2023 (from 25% in 1970). Taken together with resource extraction, agriculture and construction, the “real” economy now represents a mere 28% of US GDP, with the remaining 72% coming from professional business services, real estate, healthcare, education, finance, insurance, trade, information, arts and hospitality. (Here is a nice infographic from Visual Capitalist on the topic.)

There is no such thing as a post-industrial economy, though. Even if a country ceases to produce all the stuff it consumes, it has to import them from somewhere, lest it becomes a truly post-industrial nation — one without an economy to speak of (at least in modern terms). The “service economy” representing 72% of US GDP still consumes houses, products, raw materials and energy — produced only partially by the remaining 28% of the economy — necessitating the import of cars, pharmaceuticals and even crude oil to make up for the difference. To make things worse (or rather, as a result of turning every economic activity into a “service”), now basically every part of the economy carries a massive administrative overburden. A class of non-productive, but nonetheless actively consuming workers, and not just in the government. (Which is none of their fault, mind you: it is the fundamentally broken economic system which necessitates such an uptick in unproductive activity, not workers demanding BS jobs.)

The biggest overburden of all, however, is the owner class itself: America’s billionaires (or as economist Michael Hudson likes to call them: ‘the rentier class’). Just take a look at their top 20 list: all of them have made their “wealth” in the “service economy”; skimming off a little from huge volumes of trade transactions, be it from retail, finance or information technology. None of them has made anything tangible for a living, ever. (Except perhaps for “de facto VP” Mr Musk, but his Tesla stock look more like an investment asset than a real measure of his company’s value. His car brand’s market capitalization is well above that of other known car brands’, even though his competitors produce ten if not hundred times more vehicles a year. Tesla stocks worth as much as they do, because investors count on the growing influence of Mr Musk — just look at how the Tesla stock skyrocketed after the presidential election.)

Bad news is, the stock market is not the economy. No matter how the media tries to sell you on this idea, this prime economic indicator is for the wealthy 1% (owning 50% of all stocks), and has nothing to do with real economic output, let alone with the well being of the remaining 99% of the people. The same goes to GDP. Since most of it is generated through services like credit lending (yes going into debt increases GDP), or healthcare (which less and less of the patients can afford), it has nothing to do with how well-off the average citizen is. In fact, it is a better indicator to show how sick and indebted a society is, than how well the economy does. GDP and the S&P500 is but a thin veil masking real economic decline, the limits of energy and resource extraction, deindustrialization, the unaffordability of housing, soaring inequality and a lack of savings — not to mention ballooning credit card and federal debt. (In case you were wondering, here is a pretty good 8 minute summary on the actual state of the US economy.)

The incoming president’s much touted policies are thus just band aids on multiple gun shot wounds. Tariffs will not strengthen an economy already starved of energy. Instead, they will act as a tax on all imported goods. Similarly, in lieu of attracting foreign investment they will lend themselves to be used as a bludgeon to threaten other nations with. Despite the rhetoric, the US still remains heavily dependent on cheap imports, and is not energy independent. Not by a long shot. Sure, when you calculate the difference between the barrels of oil imported and exported, you could say that they are in balance. At least quantitatively. US oil fields, however, produce (and always produced) light crude oil, yielding a lot of gasoline after refinement, but relatively little diesel oil and jet fuel (needed to power locomotives, ships, trucks and planes). Without these so called middle distillates the economy would grind to a standstill: without diesel fuel there would be no agriculture, mining and transportation. This is why America badly needs heavier grades of oil: to compensate for a quality its own crude lacks.

Now, is it any wonder that this technical dependence puts major producers of heavy crude such as Canada, Venezuela and Iran (1) into the crosshairs of annexation attempts, regime change operations and sanctions? Let’s take Canada for example, a country producing 4.4 million barrels of oil a day on average. Even if we calculate with a depressed price of say $65/barrel (Western Canada Select), that still amounts to an export value of $104 billion a year — most of it piped to the US. Were it not for oil, Canada would be actually running a trade deficit with the US (and not the other way around)... A thing to ponder on. And we haven’t even talked about Canada’s fractured internal political landscape: so instead of annexation we might very well see the breakup of this nation, with Alberta (the major oil province) leading the pack and “voting” to join the US… Just sayin’.

Or let’s take the case with Greenland. Together with Canada, it could grant access to massive oil & gas fields in the Arctic, doubling the reserves held currently by the US in the Arctic Alaska Basin (73 billion barrels). Adding the Amerasia Basin, together with the East and West Greenland Basins, could top up that figure by 68 billion barrels in total... Securing oil is why annexing Canada and Greenland is a national security concern for the US, not their potential to be used as military outposts (these states are US military allies anyway).

There is a fly in this half-frozen ointment though. The energy and resource cost of tapping these reserves would be enormous. Floating ice could damage offshore facilities, while also hindering the shipment of personnel, materials, equipment and oil for long time periods. Not to mention the impossibility of maintaining long supply lines from the world’s manufacturing centers throughout most of the year, which would require equipment redundancy and a large inventory of spare parts. Higher wages and salaries would also be required to induce personnel to work in the isolated and inhospitable Arctic. So, would arctic oil help the US economy out? Not likely. The true reason to annex these two territories and their oil reserves would be thus to add more assets on the balance sheets of investment companies — such as BlackRock — against which unfettered lending and credit issuance could keep on going, to continue stimulating a faltering economy just a little longer. Similar to our Sun becoming a red giant in the future, US expansion into the Arctic would only fuel further growth to a bubble already ripe for explosion.

The Honest Sorcerer is a reader-supported publication. Please consider a subscription or perhaps buying a virtual coffee… Thanks in advance!

This, of course, is not to say that other industrial economies are free from this predicament (2). Each and every one of them has been built on fossil fuels powering the production of concrete, fertilizer, steel and plastics — among many other things, including solar panels and wind turbines — not to mention making long distance transportation of just about everything possible. To this very day there is still no comparable, scalable alternative to oil and gas — even though their burning causes severe climate change. We technically cannot produce food, minerals and basic building materials without them anywhere close to adequate quantities. Thus the story of their depletion (and the relentless increase in the energy cost of extracting them) is the story of industrial civilization, too.

Just like stars, after having burned through their best fuel — hydrogen — modern economies are predicated to follow a similar pattern of imperial expansion and collapse after using up all their easy-to-access resources. Europe has already went through its red giant phase in the 19th century, and after two terrible coronal mass ejection events (WWI and WWII), it has ended up as a rapidly fading white dwarf. With the changing of the guard in Washington, we are thus witnessing a mere phase shift from a hidden imperial agenda to an outspoken policy concerning spheres of interest. The presidency starting in 2025 will see a return to great power politics, driven by the material needs of America’s sputtering economic engine.

The red giant has begun to grow visibly, and its neighbors have now started to feel the scorching heat emanating from it.

Until next time,

B

Notes:

(1) Iran is a major source of medium heavy crude, and a country with the second largest natural gas reserves on the planet (after Russia). Hence the current ceasefire agreement between Hamas and Israel (although definitely good news for people on the ground) could be viewed as a necessary step in preparing for attacking Iran — just like the ceasefire in Lebanon was used to launch a devastating blow to the Syrian regime. This time, however, unlike in Syria, Russia has a vested interest not to allow a Western takeover of Iran (threatening with NATO naval bases popping up all over the Caspian sea disrupting the transportation corridor with India). China is also in for a fierce competition for oil deliveries from the Middle East, so should a conflagration break out in Iran, ALL major powers from the US to China and Russia to India could suddenly find themselves fighting it (through proxies of course and at the cost of the Iranians).

(2) China has still not reached its peak energy production, but it is drawing down its coal reserves at an alarming pace. They are where the US was half a century ago, right before oil production peaked in the lower 48 states. Although they try to build as much solar and hydro as they can, they too will have to learn the lesson Europe did: adding “renewables” to the grid has its own diminishing returns, beyond which they cause more trouble than what they solve. Russian oil production, too, has probably already peaked and is on the decline. Since, however, the country consumes only half of what is extracted, and has become self-sufficient on pretty much everything from food to minerals (and even some microchips) as a result of sanctions, it has the highest chance of surviving every other industrial nation (barring a nuclear exchange).

A very good exposition of the current polycrisis. Allow me to expand on the following sentence.

"Industrial economies must consume energy in an exponential manner in order to compensate for the steady loss of cheap and easy-to-get minerals they need for maintaining their inner equilibrium."

I suggest that people consider not only the exponential increase in energy (acceleration of the rate of energy consumption) but also the exponential increase in the exponential increase (acceleration of acceleration). In calculus, this is the move from the 2nd derivative (acceleration) to the 3rd derivative (acceleration of acceleration or "jerk"). There are higher levels too, for example the 4th derivative being called "snap." This is not a math lesson, but rather an attempt to point out the basis of what I call the hypercomplex society. The US has become a hypercomplex society because not only is the rate of consumption and financialization accelerating; it is accelerating at an accelerating pace. What this means is that the US cannot manage contraction like the complex societies of Germany and France for example. It will instead implode and collapse rather than contract. Scorching the surrounding economies and societies it interacts with like a Red Giant. The comparison is apt.

Brilliant metaphor. Here’s another one- in nature a snake often becomes hungry and looks for any easy prey. It sees its own tail and starts to eat it. As it gets deeper and deeper into its gullet and gets stuck there because of its backward pointing teeth, it chokes and dies.