What does Peter Turchin’s theory of the wealth pump, ancient civilizations, finance capitalism and Silicon Valley whiz-kids have in common?

Thank you for reading The Honest Sorcerer, and special thanks to those who already support my work: without you this site could not exist. If you are new here and would like to see more in depth analysis of our predicament, please subscribe for free, perhaps consider a paid subscription. You can also support my work by virtually inviting me for a coffee, or sharing this article with a friend. Thank you in advance!

One of my pet subjects I write relatively infrequently about is the economics of ancient times and how their ideas still affect us to this very day. As I’m not a trained historian by any stretch of the imagination, here I must rely on authoritative (albeit rather unorthodox (1)) sources— such as David Graeber and David Wengrow or Micheal Hudson — who studied and wrote many books about ancient economic systems and debt. I find Hudson’s analysis particularly relevant today, especially in combination with Trump’s rise to power in an era of ballooning debt and imperial decline.

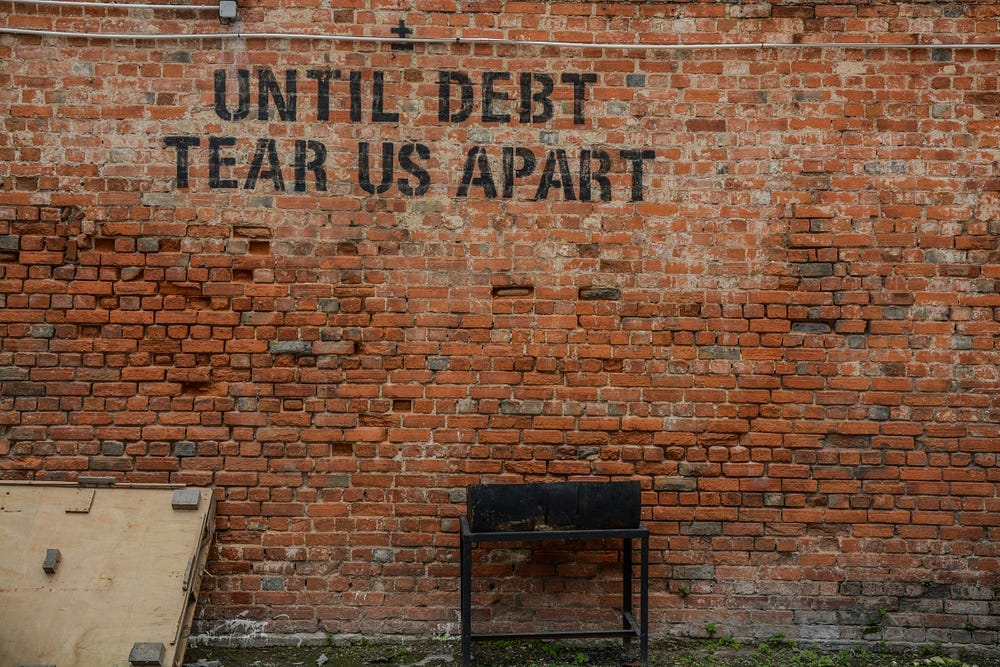

The main theme in Hudson’s theory of economics is the rise of a “rentier class” and finance capitalism, siphoning wealth out of the economy. He often contrasts our “modern” economic system, where a significant portion of income is derived from the ownership of real and financial assets, to a completely different ownership arrangement in the ancient past. And while many believe that ours is an incomparably more “advanced” system, there is in fact nothing “advanced” or “new” to it. Actually, rulers fought against the emergence of a rentier economy for many millennia. They did this for a good reason, and not only for self-preservation: it was realized early-on how inherently unstable and self-terminating would such an economic arrangement become, should it came to power. Ultimately the battle was lost three to four hundred years ago with the rise of a rich merchant class in Europe. After centuries of exorbitant growth, now we witness the system’s self-destruction on a global scale, with things unfolding almost exactly as it was forecast by Aristotle almost 2400 years ago.

Synopsis

Let’s start things off with where we are at the moment. As of today 37% of the US GDP comes from real estate, finance, insurance and professional business services (law, consulting, brokerage etc.). Activities, which produce very little tangible value, yet cost exorbitant amounts of money. Yes, these professions are a vital part to a functioning economy, but when more than a third of a nation’s GDP is spent on them, then there is something seriously and badly amiss. For comparison manufacturing, mining, agriculture and construction together represents a mere 28% of the US economy… A thing to ponder on. Based on these simple facts I believe its not far fetched to call the US and most Western economies rentier economies. But why is that a problem, besides the bad taste these words leave in one’s mouth? The answer is simple: such an arrangement strangles the economy, and will lead to its eventual collapse — even without resource depletion, climate change or wars.

Besides their outsized share of economic transactions, profit rates in the FIRE (finance, insurance and real estate) sector grew from 20% in the 1980’s (vs ~8% in manufacturing) to 35% in the 2010’s — and can be expected to rise further still. Combined with their already large (and still growing) share of GDP we are talking about trillions with a T being sucked out of the economy in form of profits every year and spent on… What exactly…? Stocks…? Bonds…? Investments in other people’s and nation’s assets only to crank up rents…? Perhaps on political campaigns…? Well, not on creating a viable productive economy, for sure. To make matters worse all this immense “value” generated by the FIRE sector, IT services and the stock market has ended up in the hands of the wealthy 1% owning 50% of all stocks and bonds. Hence the idea to measure everything in terms of GDP and market valuation, not metric tons and kilowatts produced, let alone the well being of citizens. Who cares about that, when we can charge 35% on “services” running on computers and sold to you by people in a suit and tie? (1)

And here we have an important connection point with Peter Turchin’s work, namely to the concept called the ‘wealth pump’. This is the mechanism which transfers wealth from the poor to the rich through various means — such as stagnating wages and rising profits, inflation, or via tax cuts to the rich and tax increases to the average citizen. (The recent $4.5 trillion tax cuts bill is just one of the many examples.) However, it was the transition to a “service economy” which has performed the biggest wealth transfer in human history. It has sucked all productive material investments and maintenance budgets dry, and funneled almost all funds into the stock and housing market, as well as into bloated tech bubbles (dot com in the 1990’s, crypto in the 2010’s, AI today).

This wealth transfer has resulted in the rise of a ruling class of financial, retail, fossil fuel, pharma, big ag and defense moguls who then reconfigured the entire economy in their interests. In the meantime democracy — if there was ever one — has withered on the wine. As political scientists Martin Gilens and Benjamin I. Page found in their 2014 study published by Cambridge University Press:

“economic elites and organized groups representing business interests have substantial independent impacts on U.S. government policy, while mass-based interest groups and average citizens have little or no independent influence.”

There is no other way to put it: most states around the world (including but not limited to the US) have now become oligarchies. The immense wealth accumulated by corporations, asset management firms and wealthy individuals have been successfully translated into political power via campaign donations, lobby groups, astroturfing and mass media campaigns. Such a system has not came to be by design, or via a malevolent conspiracy against the poor, though. It was an emergent feature of a complex economic system without rules implemented (and actively enforced) to prevent oligarchs from rising to power.

People always wanted to get a better life — and quite some of them wanted to get rich and powerful, too — which is fine, but only to a certain extent. Left to its own devices a “free market” economic system eventually resulted in the concentration of wealth and power in the hands of the lucky few ‘who were in the right place at the right time’. Naturally, these rising elites, once in place, wanted to keep increasing their wealth and power and, at the same time, did everything to prevent competition from taking over their positions as CEO’s, secretaries, ministers or heads of state. The “solution” lent itself to them all too easily: using their existing power these elites actively worked on reducing social mobility and forming dynasties to ensure the succession of their power. Ever wondered why most elections and corporations were dominated by the same family names for decades…?

Once on top, the ruling class tried to kick away the ladder by insisting on higher and higher entrance fees to the club. They encouraged the implementation of laws making higher education private, where they could set the (financial) bar as high as they wished. This way the ruling class hit two birds with one stone: they got the right to select who can enter their circles by limiting admission to the most elite institutions, and turned colleges themselves into a linchpin of the wealth pump machinery. By asking for ever higher tuition fees and offering student loans (you can’t default on) the wealth transfer could continue at an even higher pace.

The rise of a network state

Despite all the efforts to thwart people’s chances rising to elite circles and to prevent the overproduction of elites, quite a few managed to do so by hijacking the system. The new generation of counter elites got rich on playing big in the casino and betting on the success of tech bubbles: be it online retail, social media, electric vehicles, crypto currencies or as of late: AI. Silicon valley whiz kids, social media and online retail moguls now hold not only the vast majority of stocks and bonds, but also have a considerable sway over US politics. The techno-financial elite has by now become the main beneficiary of the system — securing government contracts on AI, cloud software, or space programs installing spy satellites en masse — and has begun to replace the old capitalist class at the helm.

The recent “revolution” in the states is thus but the final stage in this century-long saga of immiserating the average citizen and enriching the ruling class beyond measure. A silent coup is performed in the background by a small handful of tech-oligarchs as we speak, working towards a technutopian “network state” driven by AI algorithms and concentrating hitherto unimaginable levels of power in the hands of a small group of private business owners. As Mike Brock ex-tech executive wrote in his brilliant essay titled The Plot Against America:

“What we’re witnessing isn’t just a power grab — it’s the culmination of an ideology that has been incubated, tested, and refined for over a decade.

First, these thinkers argued that democracy was inefficient. Then, they created technological tools — cryptocurrency, blockchain governance, and AI-driven decision-making — to bypass democratic institutions entirely. Now, they’re no longer experimenting. They are seizing control of government infrastructure itself, reprogramming it in real-time to function according to their vision.

This is why focusing solely on the technical aspects of what’s happening inside agencies misses the deeper transformation underway. Every unauthorized server, every AI model, every removed civil servant represents another step in converting democratic governance into what Yarvin called “neocameralism” — a system where society is run like a corporation, with clear ownership and control rather than democratic deliberation. The infrastructure being built isn’t meant to serve democratic ends — it’s meant to make democracy itself obsolete.”

The key thing to observe here is the incremental manner in which the whole thing is done. “Flooding the zone” and all that bluster serve only as a distraction to draw attention away. Until, as Brock put it so succinctly:

“we may wake up one day to find that democracy was not overthrown in a dramatic coup — but simply deleted, line by line, from the code that governs our lives”

Not a warm and fuzzy image of the future, but this is what happens when capitalism turns into decay. Again, there is nothing new in this: even ancient Greeks knew that oligarchies are inherently unstable, and are thus prone to morph into tyrannies. And while populist leaders offer much needed reforms, their election can only result in another round of oligarchy at best — dictatorship at worst. Aristotle observed in the 4th century BCE already that such a hyper-concentration of power, however, often leads to resentment and conflict within the ruling class, even as public discontent turns politics into a powder keg ready to explode. And while this seems unlikely today, given the euphoria around the reforms this administration has ushered in, I guess we don’t have to wait much too long for the pitchforks to come out once the honeymoon period ends and economic decline arrives in earnest.

The past as a teacher

Despite the fact that ancient civilizations lacked the technical gimmicks of our high-tech society, they knew much more about human nature than most of us today. They didn’t have an internet of reeds, nor BitMynets or GI (godlike intelligence). They had, on the other hand, plenty of common sense and wisdom.

Ancient civilizations got rid of the problem of a rising oligarch class altogether by a clever invention called: a debt jubilee. In lean years when harvests were not so great, peasants took on credit from a class of creditors to feed their families, who in turn were allowed to charge a fee for their services. The problem was, and it is still to this very day, that when money is credited into existence (2) or given to you from a pile of gold, only the principal is handed out to you. The interest, which you must pay back on top of the principal, has to be taken from somewhere else. And in a quasi steady state economy, such as ancient Babylon or Egypt, this presented leaders with an insolvable problem.

Compounding interests on loans, which were impossible to repay after two or more consecutive bad harvests, meant that the debts outstanding had the potential to grow at an exponential rate forever, eventually surpassing the size of the entire Babylonian or Egyptian economy. Meanwhile the size of croplands (and the amount of harvest) remained more or less constant... To solve this simple math problem, jubilees were “invented” to erase debts from time to time (sometimes as often as every seven years), in order to prevent peasants from losing their land, and staving off creditors from becoming the largest asset holders in the country, amassing more wealth than the king himself. By implementing debt jubilees the kings of old managed to prevent the rise of a rentier class and thus their kingdoms could remain stable for centuries if not thousands of years.

The past couple of centuries were an anomaly in a number of way. The biggest anomaly of all, perhaps, was the discovery of technologies allowing us to transform fossil fuels into food and consumer products en masse. The Haber-Bosch process turned natural gas into fertilizer, doubling crop yields worldwide. The diesel engine relieved millions from their toils on the fields, and allowed them to work in factories powered by coal to make consumer goods. The second biggest anomaly was, that so far we were able to grow our per capita energy consumption (and therefore the amount of goods and food produced) year after year thanks to the discovery of ever larger oil fields and a globalized economy. Nothing even remotely similar has happened for such a sustained period of time in human history. Growth was always ephemeral and was followed by decline sooner or later, resetting the playing field. This second anomaly of compound growth was the only reason the economy could get away with ever rising debt levels, together with the meteoric rise of plutocrats.

The depletion of rich mineral and fossil fuel deposits, and their eventual replacement with ever harder-, costlier- and energy-intensive-to-get resources, has put an end to this massive historical anomaly called growth. And in a no-growth era debt, combined with ever higher interest rates (ostensibly to “fight” inflation (3)) and the rise of a tech-oligarchy is not only a recipe for the further immiseration of the masses, but will inevitably lead to social and economic upheaval. The fact that we are on the cusp of a massive global economic decline should now have become more than obvious. Tariffs and other trade barriers can and thus will only usher in this decline sooner and make it much worse than it otherwise needed to be (4). Presuming the latest GDP estimate of the Atlanta FED proves to be correct, the US economy is about to fall off the cliff by the end of this month already. If that’s true, the ride downhill will become much wilder than anyone could’ve imagined previously.

Until next time,

B

The Honest Sorcerer is a reader-supported publication. Please consider a subscription or perhaps buying a virtual coffee… Thanks in advance!

Notes:

(1) This is why the S&P 500 has nothing to do with real economic output made possible by the hard work of real people mining real metals, burning real fossil fuels, assembling real products made from real materials. This is why people sitting in CEO boardrooms, high government offices think that a green revolution is just a matter of investment (read: money conjured out of thin air).

(2) Contrary to popular myths about bank loans, credit is money conjured out of thin air, not something loaned to you from existing deposits.

(3) Higher interest rates are only good for the creditor class who then feel lower pain when confronted with inflation. For the rest of us, higher interest rates are an attack on our already shrinking budget.

(4) Tariffs — contrary to what you are being told — are actually paid by import companies after taking title of the goods at the port. Therefore these companies (and not the original manufacturer) must ask for a higher price from wholesale and retail companies buying the goods from them to compensate for their losses. So while companies in the country of origin will continue to ask for the same price (for them nothing changes technically speaking), local manufacturers of similar goods are now presented with an opportunity to raise their prices up to a level where they still remain competitive. Let’s say a Chinese vehicle, sold by the manufacturer for $30,000, is hit by a tariff of 100%. The import company (registered in the US) will buy this vehicle for that $30,000 from the Chinese, then pay the government the $30,000 as a tariff. They then will sell the car to a retailer at a markup of say 10% for $66,000, who then also puts his markup (plus VAT) on it, an then sells it to you for $90,000. Everybody gets richer, while you pay 3 times the price of the vehicle for… What exactly? Meanwhile, a local manufacturer realizes that his $50,000 vehicle (ex factory) suddenly looks dirt cheap, and decides to raise the price to $60,000 before selling it to a retailer, who then puts his markup (plus VAT) on it, an then sells it to you for $80,000. Everybody wins, without doing anything else than raising prices… Except you, of course. So why bother with building factories at home, when all you have to do is to raise prices to match those increased by tariffs? The fly in the ointment is the immiseration of the masses: as the discretionary budget of the average citizen get squeezed by inflation and wage stagnation, they will no longer be able to buy a car at all: thereby reducing the amount of vehicles made both in China and in the US. This, on the other hand, will lead to lay-offs and a further reduction in consumer spending… and voila: recession!

Economists like to talk about the ratio of debt to GDP, which can remain stable for decades if the economy is growing as fast as debt. But when the economy shrinks continuously, as it will soon do, the relative magnitude of existing debt will rise dramatically. Even with zero or negative interest rates, the debt burden just keeps on increasing until there is nothing left but default.

Since fiat money systems are based on the issuance of credit, widespread credit freezes and debt default will create a financial apocalypse, destroying the entire monetary system. This financial crisis will mean that markets will no longer function since, without money, they will lack a way to self-organize. Everything will shut down.

Without money, the only way to operate an economy will be by command. Some entity will have to tell everyone what to do to keep agriculture, industry and energy systems going. Since there is no Plan B for operating a command economy in any industrial country (if it can even be done), a financial crisis could just shut things down forever.

Prepare accordingly.

Bring out the pitchforks already. The reaction to the Luigi case proves people are itching for it.