Exponential growth rarely ends well — OK, it never does so. But how does it end then? Well, to use Ernest Hemingway’s beaten to death quote: “Two ways. Gradually, then suddenly.” As we are getting closer and closer to that ominous “sudden” phase — kicking into motion around 2030 — I felt the need to summarize what we have learnt so far about energy and its role in the economy. But why can’t the long slow stagnation of industrial civilization, continue for much too long? Why does a sudden nosedive seems to be imminent?

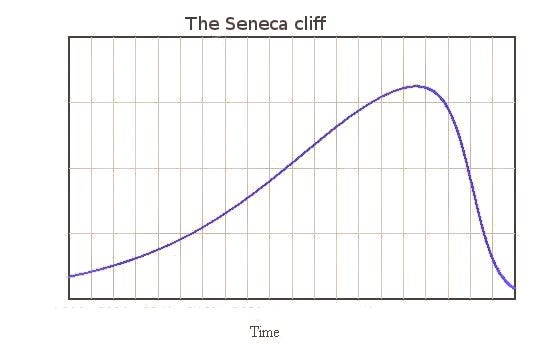

What follows is not a prediction, rather an explanation of how things could (and eventually will) turn extremely difficult all of a sudden. And when I say suddenly, I do not mean one day to the next, but throughout a period lasting from a number of years to a decade or two. Yet, compared to the historic rate of wealth accumulation and the corresponding increase in energy demand, this will definitely feel like a crazy ride down the Seneca Cliff. With that said, the onset and speed of the coming decline — as you will see — are both impacted by several factors and a great deal of uncertainty. In many cases only approximate data is available, but that doesn’t change the underlying principles the slightest, only the timing and the extent to which things will unravel. But what makes me agree with professor Ugo Bardi, who wrote — quoting Lucius Annaeus Seneca — “increases are of sluggish growth, but the way to ruin is rapid”?

For starters, and despite all the hand-waving, we are still getting around 85% of our primary energy from fossil fuels — just like fifty years ago — but unlike the 1950’s and 60’s we can no longer increase the rate of their extraction exponentially. And while that’s awesome news for the climate and the future of Earth’s biosphere, it is less so for industrial civilization. The global economy simply cannot function without cheap oil. Mining, agriculture and long distance transport all depend on low-priced diesel fuel and fuel oil. Petroleum is the master resource: making the production of all other resources possible. From food to lumber and minerals to metals all resources are harvested and extracted using oil powered machinery, and refined using power and heat from coal or natural gas — both of which are mined, drilled and extracted using oil as a prime source of energy… The same goes all raw and recycled materials going into solar panels and wind turbines, not to mention a thousand other products made from petroleum itself, including: plastics, asphalt (tarmac), lubricants, paint, cleaning agents, fibers (clothes), shoes, cosmetics, and many-many more.)

“Oil continues to be the largest source of world energy — almost 30 percent — and it is critical for transportation where it supplies more than 90 percent of total transportation fuels.” — Kurt Cobb

Hydrogen and batteries, the most frequently touted “alternatives”, however, could not possibly replace oil when it comes to logistics, mining or agriculture, as both of these technologies are a way of storing energy (at a loss), and not a source of energy per se. Thus, in order to replace oil we would not only need to dig up all the raw materials required to build these technologies (using oil, what else?), but to multiply the electric grid’s capacity in order to cater for battery charging and hydrogen production demands. (Again, doing so by mining, smelting and manufacturing all that copper and aluminum as well as other metals going into solar panels, wind turbines and the grid… By burning copious amounts of fossil fuels, of course.) Our “problem” — as a recent study by Rystad found, but failed to recognize — is that we have no more than a couple of years to accomplish this task, as we are about to max out global oil supply in five short years, facing a precipitous decline afterwards:

“In a more realistic outlook for oil production, total output would peak in 2030 at 108 million bpd and decline to 55 million bpd in 2050, with oil prices staying around $50 per barrel in real terms. Under this scenario, about one-third of the world’s recoverable oil, 500 billion barrels, would become stranded due to unprofitable developments.”

But why is that? Can’t we just pump more money (investments) into exploration and technology development to get that remaining amount out of the ground, even as the world keeps burning? And why would we see half of our current production rate gone in a mere 20 years, while it took more than half a century to see a similar increase compared to 1970’s extraction levels? Indeed, why are increases of such sluggish growth, and why is the way to ruin so rapid? As always the reasons are manifold, so let’s see all the factors at play one by one.

Exponentially rising energy cost of extracting oil, the master resource. As rich deposits (large continental fields) deplete and get increasingly replaced with costlier to tap ones, more and more energy is burned during production. While in 1970 only 3% of the energy obtained from oil had to be reinvested into extraction, now it’s a proportion equivalent to 15.5% of the gross energy produced from oil liquids, while in 2050 this number will be 50%. This sharp rise in energy cost will soon translate into a veritable net energy cliff, the prime reason behind the Seneca effect described above. In practice this means that while we can still use 85 million barrels of oil (equivalent) of the little more than 100 million produced worldwide today, net energy from oil will drop precipitously to 27.5 million barrels of oil equivalent (taking the 55 million barrels projected production figure in 2050 as a basis). Put more simply: during the course of a mere two decades — starting in 2030 — we would lose two-thirds of energy from liquid fuels compared to what we can use today, equivalent to a 5–6% decrease in net energy annually. (Similar to what the world experienced during 2020, but this time each and every year). Keep in mind: 90% of all transportation / agriculture / mining fuel still comes from oil.

Lack of discoveries and accelerating depletion of older oil fields. The rate of finding new oil has been far below the actual consumption rate for decades now, adding around 11 billion barrels per year on average, versus the 30 billion consumed every year. In 2022 and 2023 notably, oil companies have discovered 5 billion barrels only, replacing a mere one sixth of what has been consumed that year. The reason is simple: all the big oil fields have been found a long time ago already, and what remains adds very little to the overall picture (besides taking a lot of energy to find). The problem is, that while older larger fields deplete slowly at first, their depletion rate accelerates with time. This accelerating phase — unfortunately — now coincides with the rapid depletion of newer, smaller, unconventional fields (such as shale oil), resulting in higher and higher global depletion rates with every passing year. Thus the later we push peak production by investing into extending oil production from existing fields, the steeper the fall will become.

Exponentially rising energy cost of mining raw materials. Just like with fossil fuels, as rich deposits of copper (and many other critical metals) deplete, and get replaced with increasingly costlier to tap ones, the per unit energy cost of resource extraction increases sharply. This is mainly due to decreased ore grades (i.e. a percentage of metal found in a ton of rock) in new mines compared to older, now depleted pits. As a result, an ever increasing amount of rock must be hauled to the surface globally, just to keep current metal production levels flat. Since we are still mining all minerals with diesel excavators and dumpers, this process will lead to a super-exponential rise in the overall energy cost of raw materials, as the rise in energy costs of producing diesel fuel will be multiplied by the increased amount of ore needed to be shoveled on trucks and carried to a refinery. Note, that if mining were ever to become possible using solar energy provided by photovoltaic cells alone, we would still encounter the very same predicament. The depletion of rich mineral deposits would translate into an ever higher overall energy cost of producing solar panels, devices which are then used to power new mines producing even lower quality ores, resulting in an even higher energy (and material) investment needed to maintain production of new photovoltaic cells… And on, and on, and on in a vicious cycle. Now, add in the fact, that “achieving net-zero carbon emissions by 2050 will require a whopping 460% increase in copper production, which will require 194 new large-scale mines to be brought online over the next 32 years.” All this using one third of the net energy available from oil compared to what we have today, even as ore grades keep falling like a rock. Sounds plausible? Surely you jest.

Increases in technological complexity leading to higher energy demand. As any given technology reaches its physical limits, it requires another bout of innovation and the discovery of new technologies. The quiet part is, that technological progress always comes at the cost of increasing complexity: by adding more layers, more exotic materials, lengthier supply chains, elaborate manufacturing processes etc.. All of which requires more labor, more resources, and ultimately more energy. Chip manufacturing is a case in point. When the first microchip was introduced into the market it didn’t require six continent supply chains, nor laser beams exploding zinc pellets at a high frequency (to produce the UV light needed for cutting edge lithography), let alone a thousand step manufacturing process, or giga-fabs consuming as much electricity as a metropolis.

AI. Artificial Intelligence would require millions of microchips to build — not to mention the gigawatt scale data centers which will consume the entire output of a nuclear power plant or several turbines burning untold amounts of natural gas. Is it any wonder then that Google’s carbon emissions have skyrocketed by a whopping 48 percent over the last five years? “Indeed, a recent study from scientists at Cornell University finds that generative AI systems like ChatGPT use up to 33 times more energy than computers running task-specific software. Furthermore, each AI-powered internet query consumes about ten times more energy than traditional internet searches.” AI’s massive water consumption and need for exotic materials like germanium, yttrium, arsenic, gallium, or high purity alumina — for which recycle rates are still below 1% — are really just the cherry on top.

“New” energy sources. Plugging “renewables” into the grid will also increase complexity as the entire electric grid would have to be overhauled to accommodate an ever higher proportion of weather-dependent wind and solar. Thus, above a certain penetration level, their utility starts to drop as more and more batteries, switch-gear, transformers etc. have to be built into the system to compensate for intermittent power from said “renewables”. Lion Hirth in his 2013 study titled: The Market Value of Variable Renewables — The Effect of Solar and Wind Power Variability on their Relative Price has found that adding wind above 30% of the total electricity produced and solar above 15% effectively halves their market value. At least until the next threshold is reached where utilities would need to invest into even more sophisticated and complicated equipment and power-storage. Thus the statement, that solar and wind is cheaper than fossil fuels, is only true in so far as these technologies are produced and kept well balanced by the old and polluting fossil fuels they aim to ‘replace’.

Climate change. The need for more AC, combined with an increased demand for concrete and steel to repair infrastructure damaged by — or to be built to fend off — storms, floods, hurricanes and wildfires will also act as an accelerator on energy demand. Not to mention replacing ageing infrastructure, no longer capable to carry that load.

Jevons-paradox. If a technology becomes more accessible due to efficiency gains (be it via a new extraction method, or manufacturing technique, or the end product itself becoming more energy efficient), more and more people will be able to afford it, leading to its widespread adoption… Ultimately resulting in an exponential increase in energy use on a global level, the diametric opposite of what the inventors had in mind. As long as we had a growing net energy supply, this was not considered to be a problem, instead, it contributed greatly to a widespread adaption of technology; creating rising expectations and masses craving for more. As a global civilization we have thus witnessed exponential growth during the past two centuries: our population, food, material and most importantly energy consumption kept doubling every twenty to thirty-five years — fully in line with GDP growth — despite all the tremendous efforts made at increasing our energy efficiency. Energy efficiency is a bitch; creating more demand than what it satisfies.

Billions joining the high consumption crowd. Never before in human history have so many people gone through their period of energy-intensive economic development simultaneously. The changing world order and the rapid industrialization of the Global South can be already seen in their increase in energy demand; a fact hidden from sight by the massive amount of energy “saved” in the now rapidly deindustrializing West. This provides but a short respite though: consumption by developing countries will eventually replace what has been lost in the West, and Jevons paradox can be expected to return with a vengeance.

The maximum power principle. There is a rule in ecology called the maximum power principle formulated by Lokta in 1925. It can be summarized as follows: “The systems that survive in competition are those that develop more power inflow and use it best to meet the needs of survival.” This is not only true for biological systems, but human polities as well. Industrialize or be colonized is the name of the game here. Nations cannot voluntarily give up energy use, lest they risk malnutrition, discontent and exploitation by others. It follows from this rule, and all of the above, that humanity as a whole will try to squeeze the maximum power out of this planet, and will only be stopped by resource depletion, a climate catastrophe, global war — or the combination of the above.

Wars, falling exports, embargoes, choke points being blocked. Geopolitics and the rift between Eurasia and the West will continue to produce turbulence leading to sudden drops in oil supply and producing price spikes wiping out entire economies. However, except for a nuclear war, all these will be temporary phenomena.

Reflecting on Ugo Bardi’s article explaining the Seneca effect (published in 2011) — and in light of the above — it is clear that the feedback loop leading to the accelerating fall of this civilization will not be initiated by pollution or climate change. Instead, we will witness what happens when the unstoppable force of an exponential rise in energy demand will meet the immovable object of a peak and fall in net energy production from oil, and ultimately from ALL other sources, around 2030. (For Prof. Bardi’s current views on the subject, please click here.) This is not to say that climate change will not have a growing role in the decline of modernity — especially in the long run — or that it wouldn’t end civilization could business as usual continue. However, the coming steep decline in net energy production from oil (together with an absolute fall in the number of barrels brought to the surface) will certainly steal the show.

This net energy predicament cannot be remedied with more investments either, as suggested by Exxon Mobil’s Global Outlook… A document designed to scare decision makers into investing more into exploration, extraction and ultimately pollution, without telling the truth about the precipitous fall in energy returns on investment. If any oil company is ever to invest successfully in opening new oil fields (which would require more energy than ever by the way), they would need to be certain that prices could stay high enough to cover the increased upfront investment and higher running costs. The world economy on the other hand cannot simultaneously pay an ever higher interest on its debts and swallow ever higher oil prices (needed by producers). So what gives? For this reason we might be past peak already as Gail Tverberg concluded.

This is why we face a coming peak in absolute production: due to oil becoming too cheap to invest in, and at the same time, too expensive to keep the debt-laden global economy humming along.

Civilizations are complex adaptive systems, governed by the laws of thermodynamics, the availability of energetic and material inputs, as well as its environment’s tolerance for pollution. The role of the economy — viewed from this perspective — is thus nothing but to extract all the energy it can, and to convert it into a huge pile of stuff, waste heat and pollution. Whether it recycles some of the material used in the process matters surprisingly little: as recycling itself is dependent on the availability and quality of energy, which — in it’s current form at least — is subject to rapid depletion.

Needless to say, none of these inputs and outputs are easy to estimate, thus predicting when and how fast the accelerating phase of decline will arrive is just as futile as predicting weather five years from now. Everything is in motion, with each part affecting the other in some way. One thing is for sure, though: there is no equilibrium when it comes to large thermodynamic systems like human societies. They either grow, or as energy runs out, deflate and collapse. So, while we might debate how fast or how long civilizational decline will last, there should be no doubt that the current industrial model cannot last for much too long. As soon as global energy production stops growing — due to the depletion of rich fossil fuel and mineral deposits — our current arrangements will cease to work, and the accelerating, self-reinforcing phase of decline will kick into motion producing the largest Seneca cliff Homo sapiens ever experienced.

Until next time,

B

Thank you for reading The Honest Sorcerer. My special thanks goes to those who already support my work. Without you this site could not exist. And while these essays will always be free, if you would like to see more in depth analysis of our predicament, please subscribe for free or consider an annual subscription. You can also leave a tip, as every donation helps, no matter how small. Thank you in advance!

You're getting there. But you're still missing one important factor. The financial system. There are debts, globally, to the tune of hundreds of trillions of dollars. When it becomes clear that those can never be repaid, the banks, all of them, will fail all at once (you've seen how financial panics play out in the past).

How do you think this fantastically complicated machine that everyone on the planet depends on for just about everything will behave without banks?

It's going to fall to pieces like a collapsing house of cards. All at once.

You've gone from this taking multiple decades, to maybe a decade. But in places like London, or New York, or Mexico City, it'll be over in a few months at most.

The powers that be have been holding this thing back for a few decades now. Fracking etc. saved our bacon for a while. That game is nearly done and the longer they've been delaying the inevitable, the faster that inevitable will unfold, once it becomes no longer physically impossible to keep delaying.

A few places might hold it together for a few more years, but not for many. Things are far too interconnected for more than that to be possible.

Personally, judging by that Exxon graph, I'm leaning more towards 2027 than 2030.

Joe

Great summary article B. I’m curious, with the ~5 years (estimated of course), what are you and other readers doing with your time to either brace or adapt? I hesitate to say “prepare” as nobody can truly prepare for this comprehensively.