The West, led by the United States, is busy preparing for a military conflict with the largest economy of Asia. While trying to prevent China from becoming the number one economy on the planet, western politicians and economic pundits have failed to recognize that a) their economies have already lost their leading position years ago and b) China’s economic miracle is not a tad bit more sustainable than theirs was. Sure, technological progress and economic growth looks and feels fantastic while it lasts, but as the saying goes: that which is unsustainable will eventually stop. So, while the end-game is clear — a radical simplification of the global economy — the way we get there looks more and more “interesting” by the day.

Thank you for reading The Honest Sorcerer. If you value this article or any others please share and consider a subscription, or perhaps buying a virtual coffee. At the same time allow me to express my eternal gratitude to those already support my work — without you this site could not exist.

Energy and the real economy

Despite the many fundamental differences between the Chinese socialist and Western capitalist modes of production, both models are based on the same principle: the extraction of non-renewable resources and the turning of those into products using similarly non-renewable fossil fuels. And no: wind, solar and nuclear doesn’t change this formula at all, quite to the contrary. Alternative energy not only failed to replicate the versatility of coal, oil and gas, but it has remained hopelessly reliant on the availability of said fuels. “Renewables”, nuclear, hydro, geothermal etc. are still built from non-renewable minerals, mined and processed by fossil fuels.

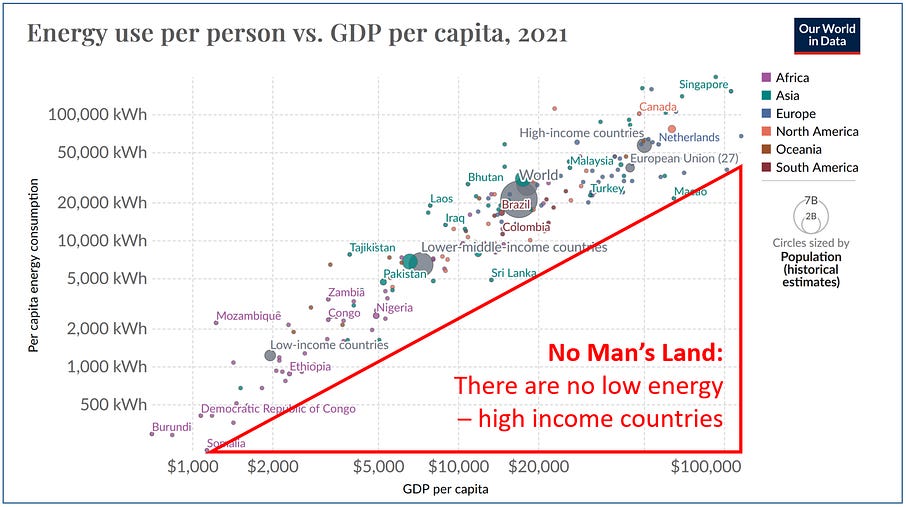

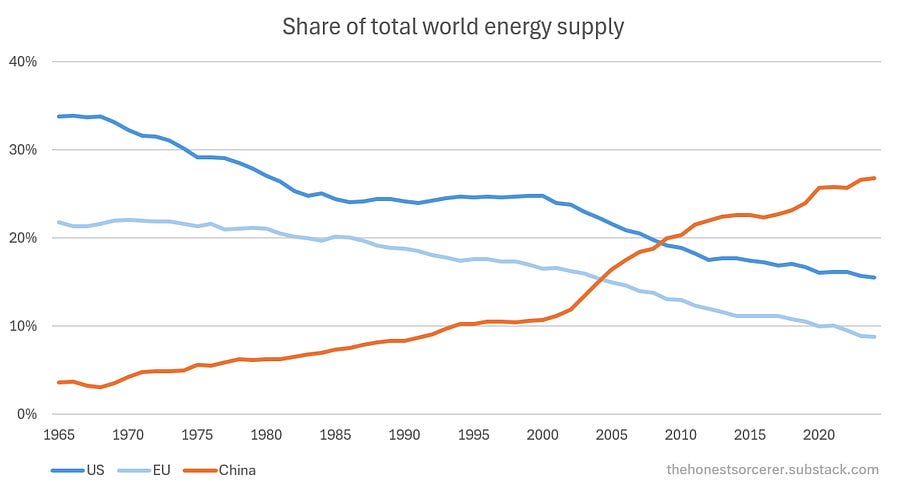

The difference between the two superpowers lie not in the technology they prefer, nor in the end goal of their economy, but in their efficiency when it comes to turning a finite amount of resources to as many products as fast as possible… One way to objectively measure this fundamental difference between the two economic models is to compare the amount of energy used by each relative to the rest of the world. As I alluded to before: that organism which converts energy and resources into it’s own copies faster and more efficiently than others will eventually outcompete and outgrow it’s rivals. This is the Maximum Power Principle first observed by Alfred J. Lotka. And it really doesn’t matter whether we talk biological or artificial self-organizing units such as the economy, this is a universal guiding principle across all complex systems. As for an illustration how this looks like in our world, just take a look at the chart below.

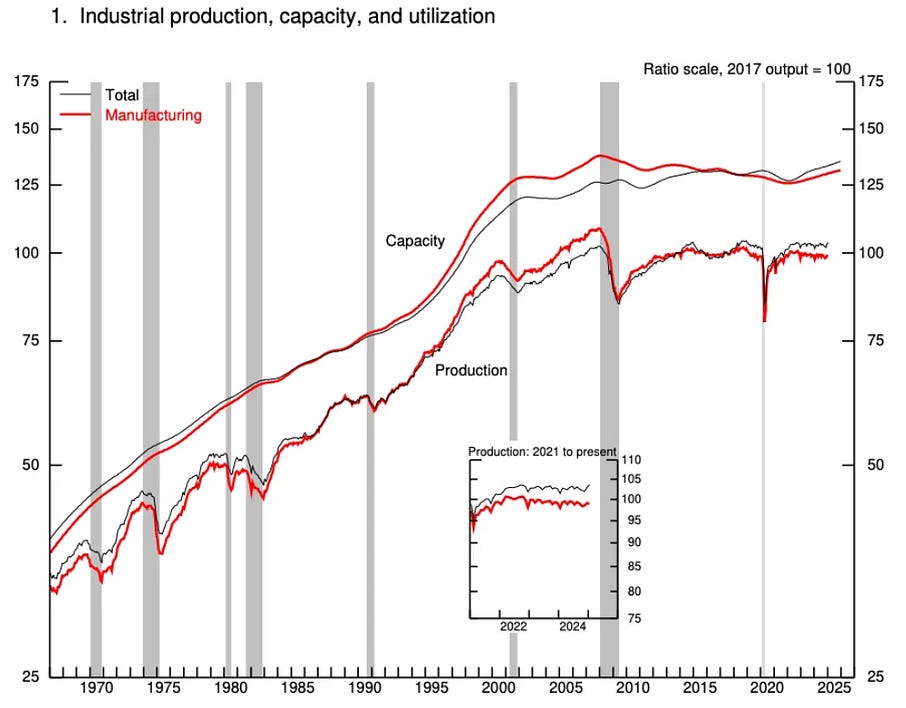

During the past six decades the US and Europe have lost their leading position as the top energy hogs of the world. Remember: energy is the economy. And those who consume the most also tend to produce the most goods, food, raw materials etc. needed to grow the economy larger and larger. According to the Chinese National Bureau of Statistics, in 2024, China’s total value-added industrial output reached $5.65 trillion, while the US stood at $3.35 trillion (1). More energy, bigger economy. In fact, growth in US industrial output stopped in 2008 already, and is stagnating ever since, while China just kept expanding its capacity:

Needless to say this does not bode well for Western powers. Their relative share of world energy consumption was reduced from their combined value of 56% in 1965 to 24% in 2024 while that of China grew from a mere 4% to 27% of world energy supply during the same time period. Considering how precisely energy use translates into real economic output (and not into financial quackery, medical scams, or stock market and housing bubbles) one can easily see how the US and Europe have lost their number one position in the world. Based on energy consumption the Chinese economy overtook the EU in 2004, the US in 2009 and the combined West (the EU and US together) in 2022. The BRICS alliance — named after its five original members (Brazil, China, India, Russia, and South Africa) together with its six new members admitted in 2024–25 (Egypt, Ethiopia, Indonesia, Iran, Saudi Arabia and the United Arab Emirates) now consume half (!) of all the energy produced in the world, making it an absolutely dominant force in the world economy.

The role of raw materials

There is much more to the topic of economic — and consequently military — dominance than energy use alone. Russia with its 5.4% share of world energy supply was able to outproduce the entire collective west in weapons, fourfold. According to NATO Secretary General Mark Rutte: “In terms of ammunition, Russia produces in three months what the whole of NATO produces in a year.” No wonder: thanks to its long standing policy of reserving excess manufacturing capacity for wartime production, together with its more centrally controlled economy, Russia was able to do what the West could not do in three years. However, they could not have succeeded in ramping up weapons production so fast without a vast amount of domestically produced energy, raw materials and components (steel, aluminum, titanium, high explosives, machine parts etc.). Something no western state can tell about itself.

Large scale warfare was always about industrial production, not platitudes or money pledged to rearmament. In light of this, it’s absolutely no wonder why western states struggle to produce enough missiles to maintain this moderate intensity conflict in Europe, let alone arm up for a much bigger one with China. As the Kiel Institute for World Economy found:

“Given Germany’s massive disarmament in the last decades and the current procurement speed, we find that for some key weapon systems, Germany will not attain 2004 levels of armament for about 100 years. When taking into account arms commitments to Ukraine, some German capacities are even falling.”

Rearmament of Western Europe is thus not only undesirable (no good ever came from that) but also highly unlikely. An economy cannot be deindustrialized and re-militarized at the same time. It’s like starving yourself of essential nutrients and calories while trying to become a world champion in body building.

Then how about turning western states into green energy and AI hubs? Well, as I mentioned above that would require a massive ramp-up in mining and resource extraction (just think about the recent rare earth craze or the lithium mania before that). Mining, just like the industry in general however, is also a function of energy use. Dumpers carrying the ore burn vast quantities of diesel fuel, excavators, ore mills and other equipment use megawatts of electricity — usually generated on site by gas turbines. So pray tell, how on earth could the US and EU economy make the amount of nickel, lithium, aluminum, silver, copper or rare earth metals it needs for its high-tech industries in a world where the West’s share of energy use just keeps falling and falling? I guess you know the answer already… Again, those easy to get, high quality fossil fuel and mineral reserves were used up decades ago already — now what remains requires an extraordinary energy expenditure to get. The ongoing deindustrialization of Europe and America affected its mining industry just as well, and exposed their markets to the whims of foreign suppliers (2). China and Russia, who still produce large quantities of these key industrial inputs thanks to their massive fossil fuel production, have thus another massive leverage over their adversaries’ tech industries.

Long in the making…

The deindustrialization of the collective West, however, did not start with their recent conflict with Russia and China. It was a result of long term trends which have only accelerated after the turn of the century and especially after the great financial crisis. During the process western economies have irreversibly turned themselves into over-financialized, heavily indebted fictional economies, where more GDP is generated by buying and selling assets, insurance, banking, healthcare, management consulting etc. than by producing real goods and services.

Seeing the upheaval after the first oil shock (following a peak and decline in US conventional oil output) the deeply unpopular banking and billionaire class of America decided to cash in on the economy before it collapses. In parallel with moving production into China and elsewhere, and thereby saving on energy and labor costs, they increasingly engaged in reckless lending policies. Instead of financing ever more riskier production growth, they wanted to lend to buy property which can be used as collateral. 80% of loans thus went to the real estate market, resulting in financial bubbles as opposed to real economic growth.

Needless to say it is not the top 1% who now bears the brunt of these decisions. As a long term consequence to the neoliberal policies originating in the Reagan and Thatcher era of the 1980's five decades of wage stagnation have now been replaced with a cost of living crisis and an outright economic decline. Persistent inflation fueled by rising energy costs, corporate greed, an ever increasing tax burden on consumption (3) together with resource depletion and deindustrialization have immiserated ordinary people, resulting in a massive wealth transfer from the bottom 90% to the top 1% of the society. The second gilded age has arrived, shinier and certainly more high-tech than the previous one: with extraordinary Mac Mansions for the elites and plastic tents for the hard working people sleeping on the streets.

Over the Pacific, in China, where the state controls both finance and capital (central banks, investments, lending policies, even large corporations) things unfolded rather differently (4). Investment decisions were made based on five year plans laid out by a central committee: “Each new five-year plan is shaped by the country’s most pressing challenges, taking into account prevailing economic conditions, shifts in industry and technology, national security concerns, foreign trade and diplomacy, and evolving demographic and social trends.” Thanks to striking a balance between central planning and free market ideology China has achieved a hitherto unprecedented economic growth, coupled with a rise of a four hundred million strong middle class. Income inequality, regional disparities, slowing social mobility, low birth rates and rising living costs, however, have slowly put an end to this miracle. Now, with population growth reversing and with youth unemployment still remaining stubbornly high, internal consumption seems to have reached its apex.

The coming world war

Internal population issues aside there are other limits to real economic growth. As a result of over investment in production and mining, China is now facing a serious over-capacity issue. Producers of high-tech goods (solar panels and electric cars) can barely break even despite generous subsidies given by the government. There are simply too many companies producing too many things. Combined with a chronic Western under-consumption crisis (due to lack of affordable energy and neoliberal policies immiserating the masses), not to mention an ongoing tariff and trade war with the West, the Chinese export model seems to be hitting its limits at the same time as its internal consumption growth began to face serious difficulties. Again, just take a look at the energy chart above: after the last bout of growth between 2017 and 2021 growth in energy supply slowed down again indicating a slow-down in the production of real goods and services (5). A massive consolidation (i.e. bankruptcies and mass lay-offs) seem to be in order… unless they are willing to risk falling into a deflationary spiral — which might have already begun. (A deflationary spiral is a downward price reaction to an economic crisis leading to lower production, lower wages, decreased demand, and still lower prices.) As the Kobeissi Letter wrote on X:

“China is dealing with severe deflation: China’s producer prices (PPI) dropped -3.6% YoY in June, the sharpest decline since July 2023. This also marks the 33rd consecutive month of factory-gate deflation, one of the longest streaks on record. Meanwhile, the consumer price index (CPI) increased +0.1% YoY, ending a four-month decline. However, excluding precious metals, CPI remained in deflation. Weak domestic demand, overcapacity, and price wars continue to weigh on prices. China’s deflationary spiral is intensifying.”

Although this is the last thing I wish to see, and I sincerely hope I’m wrong here, but

both China and the US seems to be incentivized to go to war with each other. The former to hide its overcapacity and youth unemployment issue and the latter to mask its already quite visible and accelerating decline.

Not an ideal combination for world peace, to say the least… This is not going to be your grandfather’s world war, though: technology has became far more complex since then, easy-to-get resources have become far too depleted, economies have been deindustrialized and the population no longer has the will to fight and die in large numbers. Massive land armies fighting each other for territory is no longer an option. World War III, if we get to that point, will thus come in short bursts of missile exchanges and skirmishes (such as the twelve day war between Israel and Iran) followed by a truce. It will be also waged by proxy armies, just like in the war in Ukraine between NATO and Russia. This time it will be the Philippines and Taiwan (fully backed and directed by the US) against China, or Pakistan and Azerbaijan against Iran… With the complete collapse of the INF treaty (intended to limit the deployment of intermediate range missiles) the major players are already busy populating the map with missile bases and mobile platforms — some of them with nuclear warheads… Just like children playing a game of Risk.

Conclusion

The fundamental mistake the west made, and what the Chinese economy foolishly repeated was attempting infinite growth on a finite planet. Both kept investing into the economy to turn even more raw materials and energy into even more products, even faster; not realizing that they will sooner or later either run out of buyers or raw materials and energy (whichever comes first). Economies mature no matter what their leaders do: booms are one off events, a result of a lucky combination of success factors (technology unlocking cheap resources, growth in food supply, favorable trading conditions etc.). In other words:

Growth and progress happened because it could. Now, that all the factors enabling it slowly recede into memory, growth turns into decline, progress into regress.

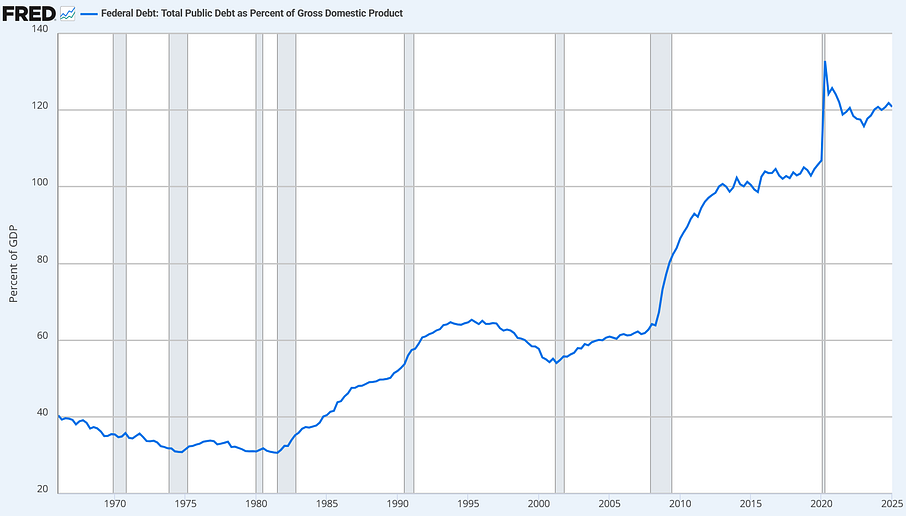

These processes are just made all the more worse by greedy elites. Not realizing that economies and civilizations follow an S-curve of growth and maturity — and eventually decline — they allowed debts to grow faster and eventually larger than the entire economy.

Canada, France, Italy, Japan, Spain, the United Kingdom, and the United States are all carrying debt equal to more than 100 percent of their GDP. Most of this “D-7” group borrowed heavily during the global financial crisis and again during the COVID-19 pandemic. Japan has been swimming in debt for a quarter century. Yet in terms of the D-7’s reliance on global credit markets, things are at their worst now.

Sounds like a ticking time bomb? It sure does to me.

The warning in the Limits to Growth study came at the 12th hour — read it, if you haven’t done so yet — but it was brushed aside. Fifty years later, the results are in, reflecting the same overshoot and collapse mode due to resource scarcity, just as it was indicated by the first model runs in the late 1960's. We are rapidly approaching the end of global industrial growth — something which has already concluded seventeen years ago in the West. Now, all our wise betters and elders can think of is how to totally mess global supply chains up; as if making sure they break right on schedule.

Policies of war, aggression and oppression are just as unsustainable on the long run as the modes of economic exploitation they are built on. If the coming (and already ongoing) missile and proxy wars don’t turn into a global nuclear exchange, then shifts in the world economy will eventually force a shift in global and also local politics. The world will no longer be as connected and integrated as before, economies will be forced to localize, large polities will eventually break up into their constituent pieces, and industrial output will recede in tandem with resource and energy depletion. Oil consumption will increasingly be directed towards agriculture and mass-transport, slowly turning many formerly high-tech states into agrarian societies. Large factories will be replaced by repair shops and a scavenger economy feeding off the remnants of once monumental infrastructure and industrial projects. Since we are talking about global trends, this won’t and cannot happen everywhere at the same time: the slow-motion decline of the industrial age will be highly uneven. Interesting times ahead.

Until next time,

B

Notes:

(1) Interestingly these figures put the two economies right on par when it comes to how efficiently one unit of energy is turned into products — at least on dollar terms. Last year one Exajoule burned in China generated $35.6 billion, while in the US the same amount of energy produced $36.5 billion in value add. The EU is somewhat of an oddball here. According to Eurostat, in 2024, the EU’s value of sold production was €5,860 billion in nominal terms (or around $6.34 trillion) surpassing the industrial output of China — which sounds rather unbelievable. Just a few examples: during 2024 China produced 3 times as many vehicles, 8 times as much steel, 15 times as much aluminum and 2.5 times as much grain as Europe — indicating that the EU economy might still be “somewhat” overvalued here.

(2) To make matters worse as high quality ore bodies deplete companies are forced to go after ever smaller batches of ever lower grade minerals situated ever deeper underground. Extracting these resources, on the other hand, requires an extra effort: more shoveling, more rock overburden to be carried away, more ore to be crushed — just to get the same amount of metal. Without a similar growth in energy supply one thus cannot expect to even maintain a level output, let alone an increase in metals produced… And below a certain level of depletion (here expressed as lower and lower metal content or ore grade) the whole exercise becomes economically non-viable (not only in money terms, but on energy investment terms as well). Oh, and by the way, the same goes to oil itself.

(3) Tariffs are payed by the importer, and are built into the final selling price of any product affected by them (and therefore are highly inflationary). In essence tariffs are a tax on domestic consumption, not on exporters. In the meantime inflation remains the top concern for Americans, with 21% identifying it as their most important issue, followed by jobs and economy at 14%, health care at 10%, and immigration at 9%. It’s hard not to interpret tariffs as another squeeze on hard working Americans in order to keep the debt-ponzi (eating up as much as a trillion in interest payments alone) going for just a little longer.

(4) In the West it is the diametric opposite: moneyed interests, earning their wealth from monopoly rents and financial “services” control the state. Again, we live in oligarchies in the West, not democracies. This is not to say that Eastern powers are more democratic on the state level — not by a long shot. The only difference is that you at least know who is in charge, unlike in Western states, where you could only vaguely point at Wall Street or the billionaire class when looking for the people calling the shots.

(5) China’s recent slowdown was primarily due to collapse of their own homegrown housing bubble and the consequent fall in steel and concrete demand (both very energy intensive to make). Production in consumer goods grew, but with an ongoing tariff and trade war, a peaking internal consumption and a limited ability of their neighbors to absorb the excess amount of exports, this type of growth looks to be ending too.

"Now, all our wise betters and elders can think of is how to totally mess global supply chains up; as if making sure they break right on schedule".

This is the silver lining in the dark cloud of the Trump presidency. The collapse of modern civilization is inevitable and, when it's over, a much smaller population will be left with a damaged world to live in. The sooner and faster collapse happens, the better that world will be.

QUOTE: "The fundamental mistake the west made, and what the Chinese economy foolishly repeated was attempting infinite growth on a finite planet."

We need to be clear about one thing: historically speaking, the Chinese at first emphatically did NOT want to adopt the modern industrial narrative at all. The very notion of trading in their traditional way of life and traditional way of thinking for a way of life and a way of thinking advocated by foreign barbarians would have struck the (premodern) Chinese as beyond ludicrous. So why did they eventually adopt the modern industrial narrative, then? Because if they didn't, then it would have been easy for those who did to TRAMPLE on them, as the Europeans and the Japanese did during the 19th and early 20th centuries. The brute reality is that, while in the long run the modern industrial narrative (which takes infinite growth as a given, of course) is indeed a recipe for devastation and ruin, in the short run it does yield enormous material power. Power which enables you to trample on others -- or avoid being trampled upon. The Chinese were not fools. They were FORCED to take that path. They had no other choice. (I shall assume letting oneself continue to be trampled upon is not a viable choice for anyone.) And China's story was probably repeated in many if not most other non-Western cultures, too.

The West is the main culprit behind what China has become today. And the Devil may pay well in the short run, but the long run is now.