What a year 2023 was. The threat of peak oil was admitted, then duly dismissed. Renewables started to show signs of hitting diminishing returns, and the much touted energy transition turned out to be what it is: a pie in the sky. Western world hegemony has started to crumble, although it will still take quite some time till a new multi-polar world could emerge. None of this has penetrated mass consciousness though. There is a nagging feeling however, that we have clearly left the old (western) world order behind, together with real economic growth. Is the end nigh then? Should we hunker down in a bunker in fear of an impending collapse? Well, not just yet.

2023 was a tumultuous year. Wars in Eastern Europe and in the Middle East. Escalating tensions in both regions. Thousands of people killed, and livelihoods destroyed. These geopolitical rifts, however, are not without roots in resource depletion — the ongoing theme in an ageing industrial civilization. Giving unconditional military support to an unsinkable aircraft carrier in the most oil-rich region of the world (which by the way is also conveniently located near an important choke point of international trade), or trying to overextend and destabilize one of the most mineral- and also oil-rich nation on the globe in order to “decolonize” it (read: carve it up), are all attempts made at maintaining global hegemony and a firm grip on resource flows.

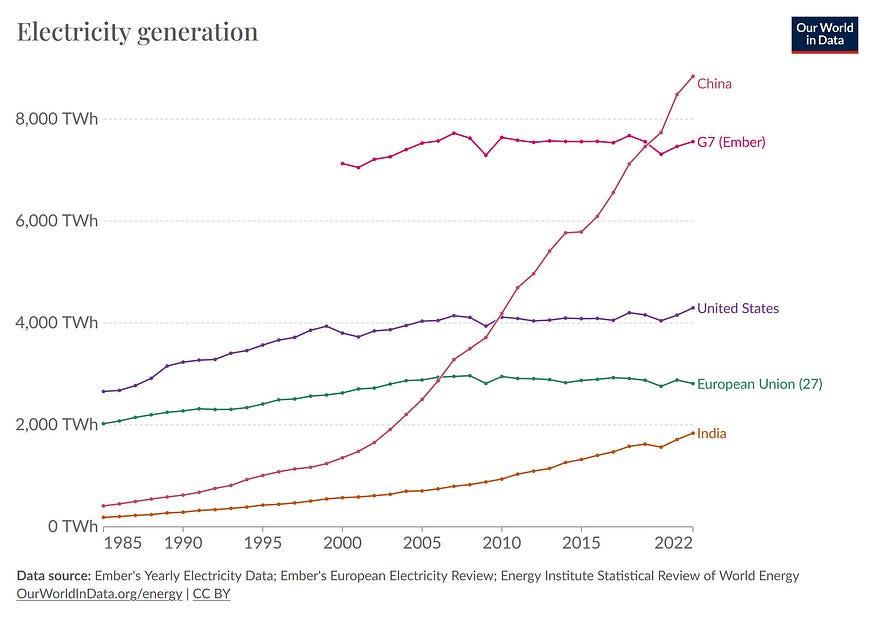

Knowingly increasing the risk of war by expanding a military alliance deemed hostile by its neighbors, and sabotaging the peace deal were just two in a row of astonishing admissions made during the year. None of these were published in the mainstream media, of course. No wonder: “news” organizations are as part of the status quo as the military-political-industrial establishment running these wars. I know that this is a highly contentious topic, but it has nothing to do with the millions of well-meaning, hard working people in the West. It has everything to do, however, with a political elite far removed from the real world and the troubles of their voters. Instead of caring for their constituents, these people have become obsessed with maintaining global hegemony, even though the military-industrial capacity to back it up is simply no longer there. Sorry, no growth in energy production, no growth in the economy. And when growth stops… Well, let’s just say that’s not a good omen for an entity hell bent on expansion. Especially not if it finds itself having been overtaken. Badly.

Meanwhile a number of “green energy” companies posted dismal financial results and were forced to halt projects due to relentless cost increases and ever higher interest rates. All this despite generous state subsidies and now bailouts. Were “renewables” indeed as cheap as touted, this would not have happened. If an investment made sense, then it gets done. If the numbers do not add up, then all sorts of financial problems arise. This has nothing to do with the fact that climate change is real and that it can easily end civilization. Capitalism is a self-terminating process in and of itself— with or without climate change. It uses up all available cheap resources, then turns belly up. In the meantime, though, it produces highly eventful years, just like the one behind us.

So let’s just review these past 12 months from the point of resource and energy depletion and their combined effects on world politics. I started this year by making a number of bold statements in an essay titled 2023 — The End of the Old World Order. Now let’s see how they fared.

#1. “More and more wind turbines and solar panels will be built, but the grid will become ever more fragile and prone to blackouts due to their inherent intermittency. By the end of the year renewables will have passed their point of diminishing returns in many places.”

According to the IEA global renewable capacity additions are set to soar by 107 gigawatts (GW), the largest absolute increase ever, to more than 440 GW in 2023. Yay! So far so good. However, the report states: “an increasing amount of electricity generation from wind and solar PV is being curtailed in many markets, particularly where grid infrastructure and system planning lag behind deployment of these variable renewables. However, curtailed generation remains relatively low, ranging from 1.5% to 4% in most large renewable energy markets.” The reason is simple: our fossil fuel based infrastructure struggles to keep up with the “green energy” boom, something which hasn’t even started in earnest yet.

“In the United States alone, Princeton estimates that the electricity transmission system will need to expand by a whopping 60 percent by just 2030. “The current power grid was constructed over more than a century,” says the New York Times. “Building what amounts to a new power grid on a similar scale in a small fraction of that time is a daunting challenge.” According to the Princeton study, doubling the current power grid by 2030 will also require the transmission sector to double its current rate of construction.”

Let me put it this way: the fossil fuel based grid needs to be replaced with a renewable one at a great material and environmental cost (valued at $100 trillion by 2050), but with no added economic benefit whatsoever. This new grid would still generate the same old 24/7 electricity for its same old industrial and residential customer base, who are now ditching fossil fuels en masse, and demand more juice than ever… Just to make and do the same old stuff they used to make and do before the transition (while expecting to pay the same old taxes and fees as before).

Sorry, it ain’t gonna happen. I know we need to reduce CO2 emissions, but it is an ever growing material and energy consumption (together with their corresponding waste streams) what is killing the planet, not carbon emissions alone. Besides, there are simply not enough copper mines to accomplish this goal… Not even 20% of it. Electrification is the textbook example of hitting diminishing returns, something which predictably arrives at the end of each civilizational cycle. It is therefore not terribly risky to tell in advance that although expansion in “renewable” electricity generation will continue for some years, it will eventually decelerate then stop well short of replacing fossil fuels. This is neither a question of money, nor political will. Magical thinking is no cure for overshoot.

Further reads with data and the underlying processes explained:

Renewables Are Slowly Approaching Diminishing Returns

No, Nuclear Energy Won’t Save Us

Solar Panels: Another Exercise in Magical Thinking

Stable Electricity: A Long Slow Goodbye

#2. “Despite our leaders’ strong desire to increase material throughput in order to return to an era of economic growth, oil production will essentially flatline during 2023. It will fail to reach it’s peak again (the level of extraction achieved in November 2018, exactly five years ago by then).”

As the saying goes: a picture worth a thousand words. So, here you go:

#3. “Geopolitical turmoil and embargoes will certainly effect output negatively, all but guaranteeing that we will never surpass 2018 in oil production sustainably. Peak oil supply will be tacitly admitted by some media organs, only to be buried under a pile of happy talk how we don’t need fossil fuels anyway.”

Oil production in 2023 has not surpassed its all time high (November 2018). While it could still grow higher later this decade, it looks highly unlikely that such gains could last any longer than a fleeting moment. The reason: 90% of production growth in the last one and a half decade came from US shale plays, where all the spigots are now wide open. Extraction of this finite resource is now pushed to the hilt, to keep oil prices low in an upcoming election year, and also to further geopolitical objectives (after the price cap scheme has largely failed). Meanwhile, peak oil got admitted and was duly explained away. Energy consultants took heed, however. As Bob McNally, a former adviser to President George W Bush who now runs Rapidan Energy Group told to FT:

“If we end up being more thirsty for oil than the prevailing forecasts assume, then we’ve got big problems. It would be an era of economy-wrecking, geopolitically destabilising, boom and bust swings. That’s when you will wish for more shale.”

Well, 2023 saw the world taking a big step towards that future. If you consider that beside peak production we have already passed peak net energy from oil (with transportation fuels now taking more energy to make than they provide), the future looks all the more “interesting”. Time to prepare for some “economy-wrecking, geopolitically destabilising, boom and bust swings.”

Further reads with data and the underlying processes explained:

The Spectre of Peak Oil — Part 1

The Spectre of Peak Oil — Part 2

#4. “LNG supplies to Europe will remain unpredictable, as ever, but will reliably fall short of filling the gap left behind by lost pipeline supplies. The hysteria around gas storage levels and prices we have seen in 2022 will never return though. The topic will be buried under news of all sorts: it will be too embarrassing, and frankly too disturbing to discuss for the political class.

Meanwhile more and more people and businesses will be unable to afford natural gas and electricity in Europe, and will turn off their taps and power themselves. This will of course create a considerable recession in the EU, one which will be labelled ‘mild and temporary’. It will be duly masked by heavily massaged GDP figures showing a mere -2% ‘contraction’ despite energy consumption falling by 20%. For those who understand that energy is the economy, this will be a clear sign of a massive, if not the biggest economic downturn the region has ever seen. For the masses, it will look like stubborn inflation and ever increasing hardship, all of which will be blamed on — of course — sick and evil dictators.”

Here, again, the numbers speak for themselves. 2023 passed without any hysteria about natural gas prices and storage levels in Europe, but the cost of this vital commodity was still 3 times above the long term average and four times higher than on the other side of the Atlantic. There as a response LNG exports have duly approached record levels, together with shale oil shipments abroad. Who would have thought that a war in Europe could be soooo good for the fossil fuel business…?

Despite record high shipments and storage sites filled to the brim, demand for gas in the European Union has still declined by 19–22% in the first three quarters of 2023. No wonder: deindustrialization in Europe is in full swing. Many chemical and metallurgical production sites were closed, together with fertilizer plants. Real economic output has been significantly reduced. According to the ifo Institute: “In manufacturing, the Business Climate Index fell noticeably. Companies assessed their current business situation as significantly worse. Their expectations also grew more pessimistic. Energy-intensive industries are having a particularly tough time. Order books continue to shrink overall…” As a result the IEA is now forecasting a drop in diesel demand for Germany by some 40,000 barrels per day (a fall of around 4%) for 2023. Since diesel is mostly used by commercial vehicles (trucks and heavy machinery) this single metric alone should indicate a corresponding fall in real economic output.

If you look at GDP figures, of course, none of this can be seen. As deindustrialization marches on (combined with a fall in consumer demand due to inflation), the fall in GDP has been kept conveniently “in balance” by a similar uptick in financialization. (A process whereby financial markets, financial institutions, and financial elites gained an ever greater influence over economic policy and economic outcomes.) Here, I must admit, I seriously underappreciated the financial elite’s capability to sell a significant economic decline as a modest decrease in Germany (-0.5%) and an overall growth of 0.7% in the EU. Well done.

Further reads with data and the underlying processes explained:

The Precipice: Europe on the Verge of Its Long Decline

Financing the End of Modernity

#5. “The West — together with the oil age which gave rise to it — has hit hard limits to growth. Its failed expansion eastwards has smashed into a brick wall in 2022, despite the countless warnings given both from the inside and the outside. The resulting war has killed and maimed hundreds of thousands and obliterated an entire country. By the time the inevitable (but entirely predictable) military debacle arrives for the West sometime during 2023 though, the failed ‘expansion attempt which never was’ will be rebranded as a ‘peace keeping mission’.”

Here we have a mixed bag. The military debacle did arrive during the summer, consuming the third army assembled and directed by the West, after the previous two were vanquished. During the much advertised spring-summer-fall counteroffensive tens of thousands died needlessly as they were approaching heavily fortified lines across minefields without air cover… on foot. One cannot overstate how disastrous this defeat was. It made western weapon systems, training and strategy look wholly inadequate and sapped a nation of its last pool of reserves.

On the other hand, the “peace keeping mission” and the demarcation of a demilitarized zone did not happen as I opined. Instead, we are now looking down the barrel of a total state failure and collapse. Insisting that a military can win without shells, manpower and a viable strategy does not help here the least. Believing our own propaganda about similar casualty levels on the other side (which is simply and factually wrong) does not bring back the dead either. Let’s face it: the western political class — in a vane attempt made at toppling one of its key adversaries to take control of its resources — has destroyed and depopulated yet another country, and pushed Europe into deindustrialization. Now the western military alliance faces a humiliating defeat, threatening with its complete dissolution.

Further reads with data and the underlying processes explained:

Europe Is Being Deindustrialized With a Purpose

2024. Just as I wrote at the end of my article one year ago: it looks increasingly like that the end of our one and only global industrial civilization will be an uneven process, just like the end of the Roman Empire was. Analogous to the fall of Rome, the western half of our global civilization will continue to fold under the many pressures until it finally crumbles somewhat sooner than its better shielded Eastern part. This time though, we won’t have to wait a millennia between the fall of the two halves...

We have seen the peak of Western civilization, and soon the peak of industrial civilization altogether. From an individual human’s perspective this is still going to be a slow grind, one which will take decades to unfold — hopefully not something ending in a loud and rather radioactive crash. So while it’s good to have some stashed food and potable water, one cannot sit out this long emergency in a small bunker. Building a support network of friends, family and neighbors, combined with acquiring a set of useful skills and developing alternative revenue flows would do a much better job in my view.

Finally, let me close by quoting Dr Tim Morgan, former head of research at Tullett Prebon. As he brilliantly summarized the state of affairs recently on his fine blog Surplus Energy Economics:

I don’t know what you’re hoping for in 2024, but I’d settle for a bit of old-fashioned reality. Like Alice in both of her famous adventures, we seem to have stumbled into a parallel world where nothing is quite what it seems.

The economy carries on growing, even though it isn’t. In this Wonderland that we’ve created out of whole cloth, debt doesn’t matter, creating money out of the ether isn’t inflationary, and we can borrow our way to prosperity whilst money-printing our way to financial sustainability.

Technology has abolished the laws of physics, and we can enhance our prosperity by reducing the density of the energy inputs that drive the economy. Carl Benz, Gottlieb Daimler, the Wright Brothers and Frank Whittle got it wrong when they decided to power their cars and aeroplanes with petroleum rather than windmills. W. Heath Robinson and Salvador Dalí painted reality much better than Rembrandt van Rijn and Nicholas Pocock.

Expect more surreal statements than ever from Western leaders, more baloney, more clamp down on free speech, more war, more profits made at the very top at the cost of average citizens, more climate change and higher temperatures than ever. I won’t go into exact predictions this time, this article is already way too long. All I want to say is this: use whatever time is left from this unsustainable bonanza to build resiliency, but also do not forget to enjoy the wonders of this marvelous world. This is your only chance to live your life to its fullest.

Last but not least, let me thank you for all your support throughout 2023, you really made a difference. Bless you all.

Happy New Year!

Until next time,

B

Thank you for reading this post. If you would like to see more in depth analysis of our predicament, please subscribe for free — and if you can afford it, consider supporting my work by opting for a paid subscription or taking a snapshot of this QR-code (alternatively by clicking the link below). Thank you!

Wonderful article, really well said. I couldnt agree more.

Thank you B🙏