The Mythical Return to Coal

The black swan has sang its song - too bad no one took notice

There seems to be a growing belief that we could safely fall back on coal if we needed more electricity, or should all other options fail due to supply chain bottlenecks. Data suggests, however, that we are facing the same double whammy with coal as with oil or other energy resources; resulting in a worldwide peak and decline in coal use — no matter what. So while the savior of industrialists / the nightmare of environmentalists might never come true, we could still find ourselves sitting in the dark.

Thank you for reading The Honest Sorcerer. If you value this article or any others please share and consider a subscription, or perhaps buying a virtual coffee. At the same time allow me to express my eternal gratitude to those who already support my work — without you this site could not exist.

Coal never went away

Modern civilization faces many predicaments; essentially all stemming from the over-exploitation of natural resources and the immense pollution released by their consumption. Contrary to common sense — dictated by economic theory — overshooting natural limits cannot be overcome by replacing one resource with an other, or by hoping that rising prices would incentivize more extraction (and make all the bad things disappear). In reality we are at the cusp of a major tipping point, marking the end of centuries of growth and the onset of what we could call ‘radical simplification’. And what could be a better example for all this, than the energy resource starting it all: coal.

The black rock hasn’t left the scene with the advent of oil or nuclear — let alone “renewables” which are anything but. The reason is simple enough, these energy sources are not interchangeable, but complementary. Oil needs machines and pipes to be extracted, refined and used. All of these equipment, however, is made mostly from steel, which in turn is made by burning copious amounts of coal. And not just any coal, but the purest type with the highest energy density: metallurgical grade coking coal. The rest of the (much lower grade) carbon fuel can thus be burned in power plants, so that oil — moving more than 90% of all goods and people across the surface of the planet — need not to be combusted to generate electricity.

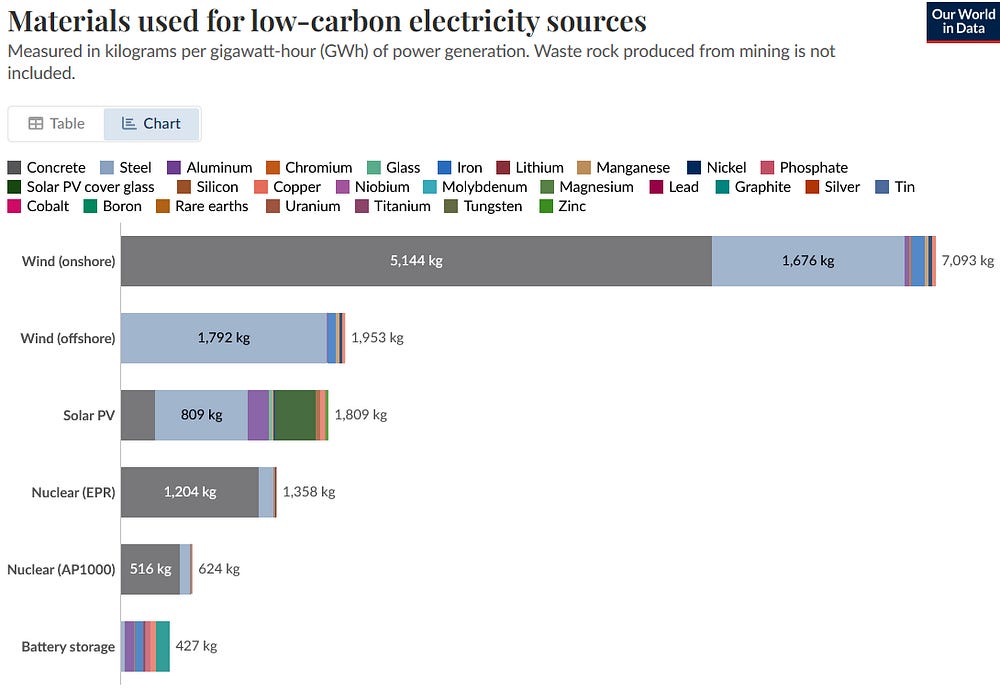

Nuclear power plants, producing fourteen thousand times more electricity per ton of fuel than coal, too, require steel and concrete to build, as well as a fleet of diesel trucks to mine and deliver uranium to power them… Not to mention an external source of 24/7 electricity to run their cooling pumps. Many of these inputs, however, would become unavailable without coal. Take Portland cement for example, where coal is not only a source of heat, but fly ash as well — an important component in the cement mixture. So while alternative fuels, such as natural gas, gets increasingly mixed in as “alternative fuel” in cement manufacturing, it still cannot fully replace coal.

You see, coal has not disappeared with the advent of new technologies, just moved into the background. All of our “low-carbon” energy technologies rely predominantly on concrete and steel — both made with coal. Does that mean we could burn much less carbon by first turning it into other energy harnessing technologies — including gas turbines and solar panels? Yes. In a certain sense, all of these technologies — ostensibly aimed at getting rid of the most polluting fuel — are just a smarter way of burning coal. By using the black rock to produce metals, silicon wafers, cement etc. (then building power plants from these), we are simply increasing the amount of electricity generated by burning the same amount of coal. In practice we just kept increasing the efficiency with which we use coal over time. First by switching to internal combustion engines, then by adding solar panels and EVs to the mix. And has that led to an overall decrease in coal’s use?

Hell no. Quite to the contrary.

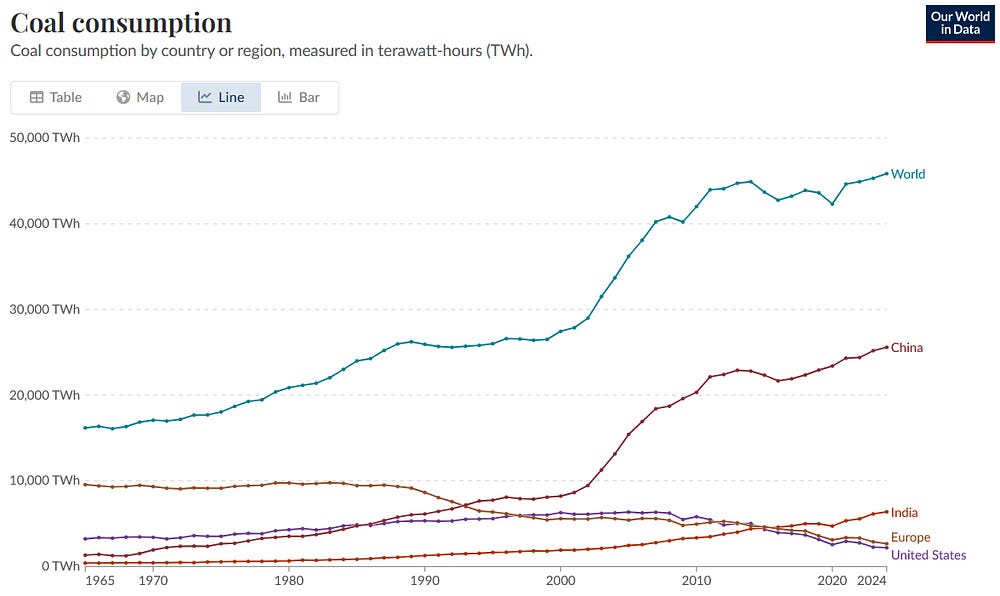

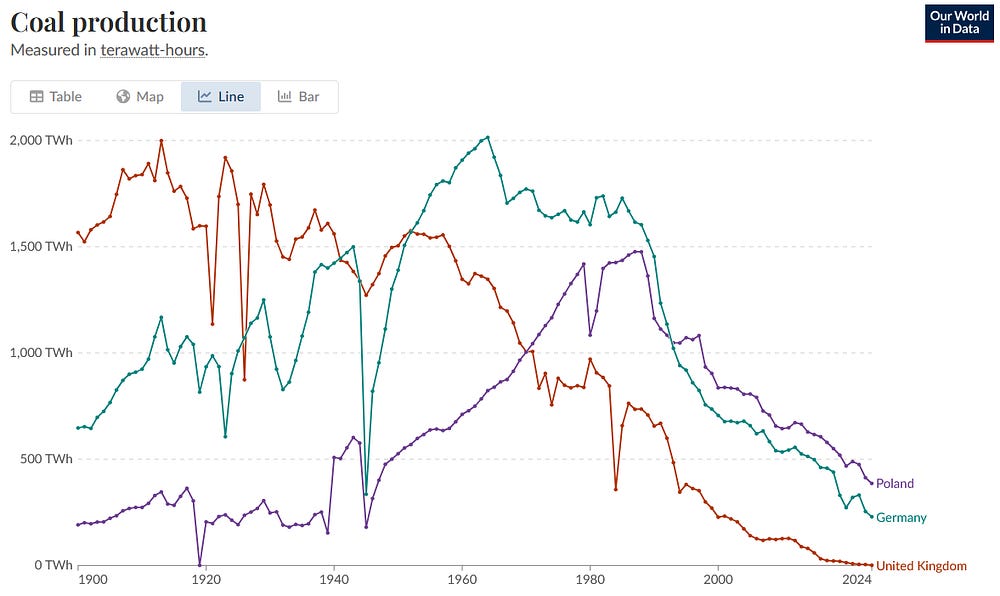

In 1865, economist William Stanley Jevons observed that more efficient steam engines, perhaps paradoxically, led to increased coal use. As the fuel cost per unit of work was reduced, so could more and more businesses afford to run a steam engine, leading to a steady increase in coal’s overall consumption. And as you can see from the chart above, this trend hasn’t stopped ever since Jevons made his observations. In fact, it was only turbocharged by the advent of oil and nuclear. As coal was no longer required to move ships and locomotives, and only the best part of it (anthracite) was needed to be used to make more machines, regular coal and lignite became so cheap, that a mass electrification of entire continents have suddenly become feasible. Add to that the fact that open pit mines were also made possible by diesel engines hauling away entire mountain tops — making coal’s extraction cheaper than ever — and you have a supermassive positive feedback loop. More oil powered machines, more coal. Yet more machines, even more coal.

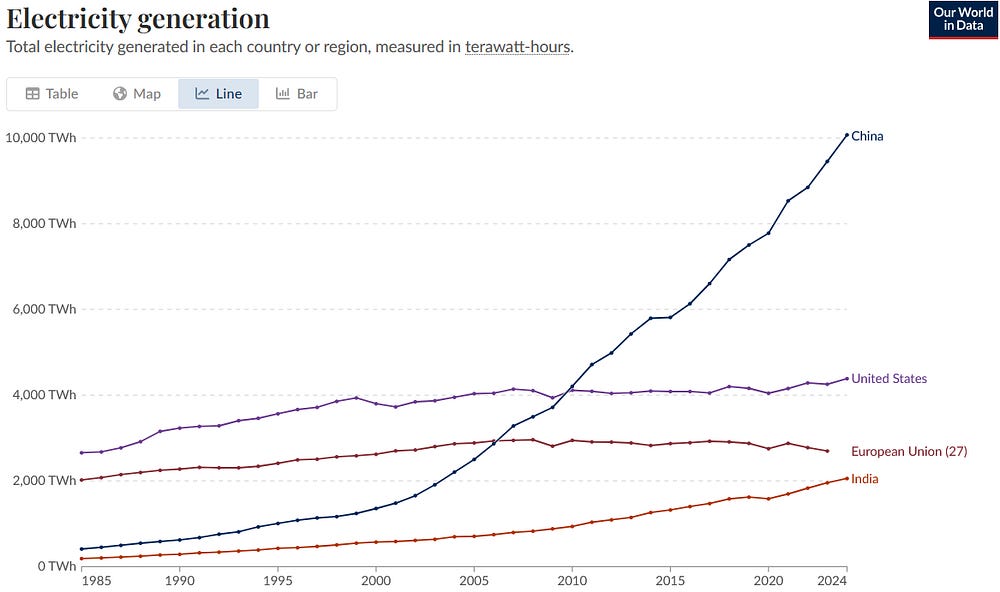

The use of coal worldwide has thus continued to grow exponentially, hand in hand with the utilization of every other fossil fuel and nuclear energy. At least until 2011, when growth in Chinese coal consumption stalled — at the same time when European and American use of this solid fuel began to decline. Superficially we could say, ‘Oh, coal was just replaced by natural gas, which can be used to generate electricity even more efficiently’ — but that’s just half of the story. First, demand for electricity in the West has stopped growing after the great financial crisis (and only returned to growth recently in the US with the advent of data centers). Basically we have electrified what could have been reasonably electrified (and no, road transport doesn’t belong to that category). Second, the real economy has entered an era of stagnation, and in the case of Europe, it began to decline sharply as the continent began to deindustrialize.

Meanwhile, the price of electricity in the West just kept rising, climbing a good 30% higher during the past five years, disincentivizing any further growth in power demand. (Again except for powering the AI-bubble.) These rising prices has started to eat into people’s budget, forcing them to cut back on consumption — and not just direct consumption (at home), but indirect use through reduced purchases of goods and services requiring electricity to make or provide (e.g.: eating out).

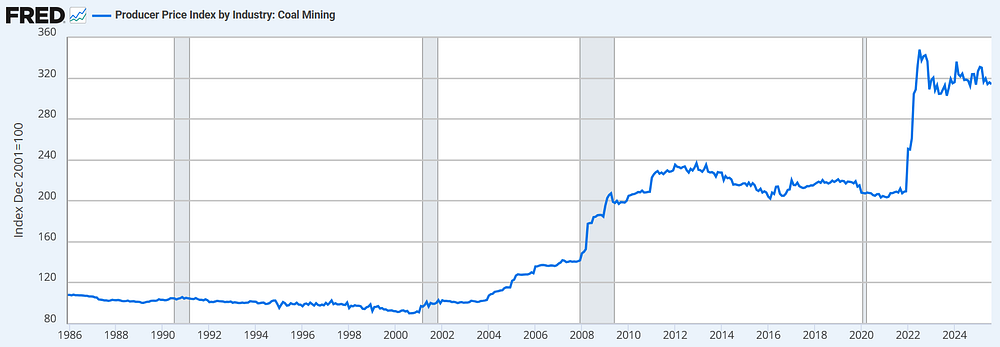

On the supply side of things coal production also took a hit as coal prices could no longer keep up with climbing extraction costs. As shown by the Producer Price Index (1) dataset above, the cost of mining coal effectively doubled between 2004 and 2012, then grew by another 50% in 2022 when the sanctions put on Russian coal has sent fuel and electricity prices soaring worldwide. You see, coal is mined with diesel engines and electric machinery — and if these input costs rise, while coal prices fall back to previous levels, mines’ profitability plummet. At the same time when coal got more expensive, natural gas has become a lot cheaper thanks to hydraulic fracturing. This has led to nearby natural gas fields outcompeting coal. For example the Marcellus and Utica shale gas fields near Appalachia, a major source of coal in the U.S., has led to the closure of a number of coal fired power plants and their subsequent replacement with gas turbine power generation.

Depletion is king

Coal, just like any other mineral resource, however, is neither infinite nor is evenly distributed. Some of it lies close to the surface and provides high quality anthracite. Most of it, however, is either situated much deeper underground or further away from major industrial and population centers… Or simply is of a much lower quality. This means, that after harvesting the highest quality, easiest to get portion, mine shafts have to go deeper and deeper at an ever increasing cost, or mines would have to be opened further and further away from where coal is used. As an analysis on the matter found:

“These higher prices are seen most acutely in the Appalachian coal producing regions, where coal has been more expensive for years due to the depth of coal within the mines, a problem that only becomes more acute with more mining.”

The depletion of easy-to-get coal had two major implications. First, transportation costs began to rise: from 30% of the delivered cost in 2009 to 40% in 2023. Coal is heavy, bulky and contains a lot less energy per ton than hydrocarbons. Since it cannot be transported by pipelines either, barges, trains and trucks — all operating on diesel fuel — must carry it to the closest power plant, steel mill, or port (for export). This not only exposes the high impact diesel prices have on delivered coal prices, but also the fact that without adequate diesel fuel supply entire industries would have to move closer to coal mines — which is a highly unlikely scenario, if you ask me.

The second major implication is the relentless rise in the cost of operating mines themselves. Open cast mines, produce coal at one third of the cost per ton compared to underground facilities. This means that as surface mines deplete, and we have to dig deeper underground for coal, extraction costs could blow well past the selling price of the black rock. And again, as demand for electricity stagnates and as electric bills get more expensive, these higher extraction and delivery costs will soon become impossible to justify. The analysis, cited above, shows that in 2024 coal power was 28 percent more expensive than in 2021, costing consumers $6.2 billion more to generate power via coal than it would have cost in 2021. Not only the cost of fuel and delivery has increased for plants, but operations, maintenance and capital costs as well, due to aging power plants and inflation. Plants also ran less on average since 2021, which drove up their cost in dollars per MW-s generated, making these even less competitive to other sources of power. As a result, nearly half of these generating units saw their costs increase double the rate of inflation over the 2021–2024 period.

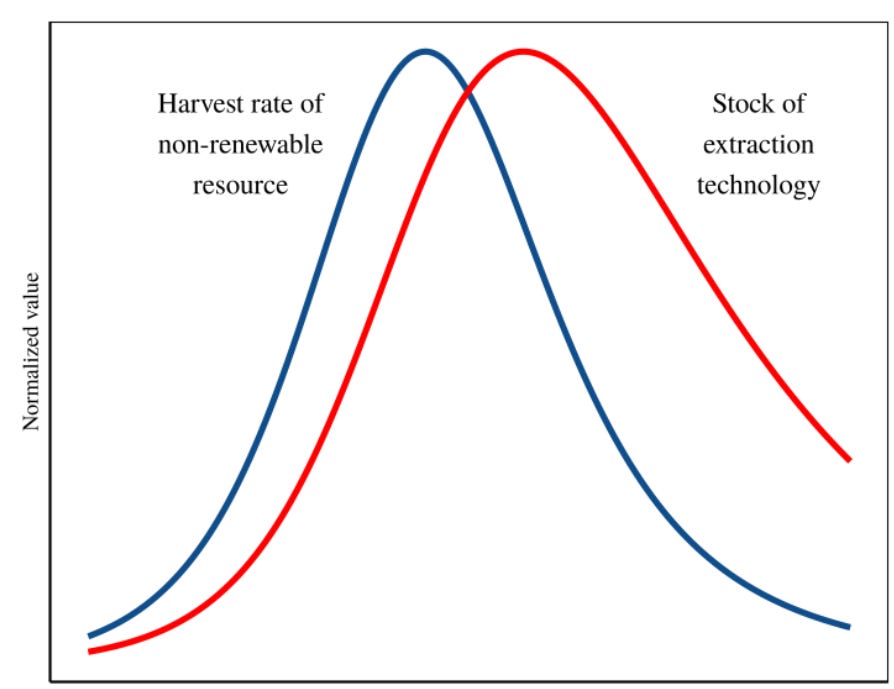

To add insult to injury, many countries experience a peak in coal extraction before power plant capacity reaches its maximum. In practical terms this means, that grid operators often add more power plants than what could be economically operated, ending up with a huge overcapacity — even as collieries begin to deplete and as extraction becomes ever more costly. This double whammy of rising input costs and worsening energy returns on energy invested then leads to a collapse of profitability and ultimately both power plants and mines being left to rust.

It’s interesting to note here that natural ecosystems display a similar pattern, called predator-prey relationship. For example an expanding wolf population will cut into the growth rate of the neighboring sheep population, causing it to decline. This eventually leads to a situation where there are more wolves than what could be supported by the number of sheep in the area, causing the predator population to decline — with a slight delay. As Blair Fix showed so brilliantly, the same dynamic can be observed during the extraction of non-renewable resources, where mining equipment and machines represent wolves, and the resource in question — in our case coal — equals the sheep, the pray our predatory system feeds on.

Coal power generation all across the world has thus found itself on a downslope. Not because of other electricity generating technologies taking its place, but because of depleting coal mines and ever worsening returns on investment. You see, we would experience the same downturn of coal production even without alternatives to take its place. The only reason the swan song of coal is not heard is that it’s droned out by the coming online of “alternatives”. Hence the selling of this story as “progress”. If natural depletion continues as it is, however, eventually coal fired power plants will all have to close in the years and decades ahead, and there will be no return to coal. So even if gas turbine shortages, or supply chain bottlenecks would force companies to return to burn the dirtiest of fuels, they might end up finding a dead black swan where they expected a unicorn to pop up.

And, no, it really doesn’t matter how badly any administration would want to keep coal alive, either. By issuing a series of executive orders to reduce the number of plants subject to EPA’s Mercury and Air Toxics Standards, and to keep uneconomic plants running long-term using short-term emergency powers, they could keep these plants open just a little longer — but could not possibly restore their profitability. So while these actions have granted “pollution passes” to 71 high-pollution plants so far, including coal plants and dozens of copper smelting facilities, consumers will eventually have to foot the bill. According to Grid Strategies, a power sector consulting firm, American ratepayers will pay more than $3.1 billion in extra power bills every year if fossil fuel plants slated for retirement continue operating through 2028.

As a result of the rapid deterioration of coal’s economics, 99 percent of coal plants are now more expensive to continue operating than being replaced with local wind or solar. “Replacing coal plants with local wind and solar would also save enough to finance nearly 150 gigawatts of four-hour battery storage, over 60 percent of the coal fleet’s capacity” — according to the authors. However, and as I explained elsewhere, this is still nowhere near enough to compensate for the day-to-day variability in “renewable” electricity supply, let alone for the huge seasonal variations so pervasive in the global North. So, while on paper at least, “renewables” might seem to be a cheaper option, intermittent wind and solar simply cannot compensate for the loss of stable baseload supply. (Oh, and besides that, these technologies still require the burning of tons of coal — just elsewhere.) Simply put as coal (and later natural gas) gets more expensive, many consumers will find themselves priced out of the market, or will be forced to put up with an increasingly intermittent power supply.

A glimpse into the future of coal

A depletion induced collapse of the coal power sector is neither a uniquely American, nor a recent phenomena. European coal production is well past its all time high, and by the time the Green New Deal was signed in 2019, more than half of the 1982 peak European supply was lost already. British coal extraction peaked in 1913 (!), the German in 1964, and the Polish in 1988 — and neither happened because of climate concerns. Let’s take Poland, a true laggard when it comes to “phasing out” coal, for example. Following Europe’s sanctions on Russian energy (needed to keep coal mining profitable) Poland experienced a doubling in coal production costs in 2022. By 2025 high input costs (electricity and diesel chief among them) has forced mines to sell their produce well below the cost of extraction. The issue has been made worse by natural depletion: as mine shafts went deeper and deeper, the cost of bringing up coal increased exponentially… Again we see the same double whammy: rising input costs and worsening energy returns on energy invested. At the same time, Polish power plants will be have to be shut down due to age and costs. After 2025, when public support ends, the first 8 GW of coal capacity may leave the Polish system, and a little later, another 6 GW.

Extend that declining curve to zero, please.

With an increasing number of countries announcing the “phase out” of coal, and with deindustrialization in the West raging on, this trend can only be expected to accelerate. So while it might be fashionable to use the term “phase out” for an age and natural depletion induced coal infrastructure collapse in Europe, the fact remains a fact: there is no return to coal here, either. Once the crumbling of the coal supply chain accelerates beyond a point — bringing all prior economies of scale with it — and as mines go bankrupt one after the other due to rising costs and worsening returns, the death spiral becomes inescapable.

Make no mistake, from an environmental perspective this is no doubt good news. As for the future prospects of industrial civilization, well, not so. Once shut close, reopening mines, rebuilding power plants and infrastructure would not only cost huge amounts of money, but would put us back on the same treadmill of depletion and worsening returns. To do so would thus presuppose an ever growing economy capable to pay the ever increasing cost of coal generated electricity… But with oil and gas also peaking, people becoming poorer by the day, and all possible ecological and climate boundaries being passed, what’s the chance of that coming true…? (Rhetorical question.)

And if coal production can peak both in America and Europe, it sure can (and most certainly will) peak in China, Australia, and India as well. And if the European use of the term “phase out” of coal is anything to go by, China’s goal to hit peak carbon emissions by 2030 and carbon neutrality by 2060 signals an imminent peak in coal output there, too (2). And since carbon based fuels are still essential to make steel, concrete, silicon wafers etc. this will also signal a coming peak in industrial output and electricity generated. Folks, we are not talking about centuries, but a few decades under which miracles would need to happen.

Coal, oil and gas is not being phased out — we are running out of the accessible portion of these fuels.

So while hydro, nuclear, wind and solar power plants will continue to be made and feed power into the grid after fossil fuel consumption peaks, grids will become increasingly unreliable and fragile as baseload and spare parts slowly disappear. From a day to day perspective, the decline in electricity supply thus won’t look like what you see in the movies. Instead of a sudden zombie apocalypse, expect a flickering, increasingly unreliable power supply… Till two to three decades down the line the once continuous ocean of energy dries up, leaving only a few small ponds here and there where electricity is still available. The rest will have to learn how to do without 24/7 power.

Until next time,

B

P.S.: listen to this highly informative podcast from Nate if you want to learn more about how grids operate and why baseload is critically important.

Thank you for reading The Honest Sorcerer. If you value this article or any others please share and consider a subscription, or perhaps buying a virtual coffee. At the same time allow me to express my eternal gratitude to those who already support my work — without you this site could not exist.

Notes:

(1) The Producer Price Index calculates price changes in private contracts based on suppliers’ input prices. It is thus a measure of a measure of wholesale inflation, while the Consumer Price Index measures the prices paid by consumers (source).

(2) During the first half of 2025, “renewables” already generated more electricity than coal worldwide, for the first time in history. Electricity from fossil fuels seem to be on a high plateau in China, too, and with a continued rapid expansion of wind, solar and nuclear coal use can be expected to fall in the years ahead all around the globe. However, since the production of nuclear, hydro, and “renewables” still depend on coal, natural gas and oil, the same predator-prey analogy applies to them as with coal and its power plants. However, the delay between peak fossil fuel use and the peak electricity produced by these “alternative” sources will be much longer, due to the lifecycle of these technologies. (“Renewables” take a huge upfront investment from fossil fuels, but can operate for decades with minimal fossil inputs.)

The Jevons Paradox observation is particularly devastating to the green energy narrative.

Our civilization built its foundation on cheap, abundant energy, and that foundation is crumbling beneath us.

What’s most revealing is how the depletion narrative is being disguised as progress.

And still we continue to avoid the biggest bubble of all and one that can’t easily be solved, the population bubble. As the continued growth of energy supply grows, the amount of energy available per person merely maintains or declines. The short term solution is to limit energy to the wealthy nations while millions in Africa starve due to lack of energy and its byproducts, food primarily. But ultimately lack of energy will affect us all, except for the super rich of course. But their time will come too.